How to: setup and generate certified payroll

Tags: Payroll, Process, Project, Reporting, Subcontractors

Overview

Certified payroll is a specialized type of payroll reporting used for federally funded or assisted construction projects subject to the Davis-Bacon Act and related legislation. This act mandates that contractors and subcontractors working on public works projects (i.e. government-funded construction), must pay workers the locally prevailing wages and benefits.

When is it required?

Certified payroll is required in the following situations:

- Federal Construction Projects: Contractors and subcontractors on construction projects funded by the federal government or with federal assistance (usually valued over $2,000).

- Davis-Bacon Act Requirements: Projects subject to Davis-Bacon and related acts, which mandate prevailing wage laws for laborers and mechanics.

- State-Level Public Works Projects: Some state and local governments have similar prevailing wage laws that also require certified payroll reports.

Why is it important?

Certified payroll serves several important purposes:

-

Compliance with Labor Laws: It ensures contractors and subcontractors comply with the Davis-Bacon Act by paying workers the correct wages and benefits as dictated by law.

-

Worker Protections: It prevents wage theft or underpayment by providing a transparent record of wages paid to workers.

-

Government Accountability: It helps government agencies monitor and enforce prevailing wage laws on public projects, ensuring that taxpayer dollars go toward fair wages.

-

Avoidance of Penalties: Failure to comply with certified payroll requirements can lead to severe penalties, including fines, debarment from future federal contracts, and withholding of payments.

Prerequisites

Before Trayd can automate the certified payroll report for your project, you should make sure you have completed the following:

-

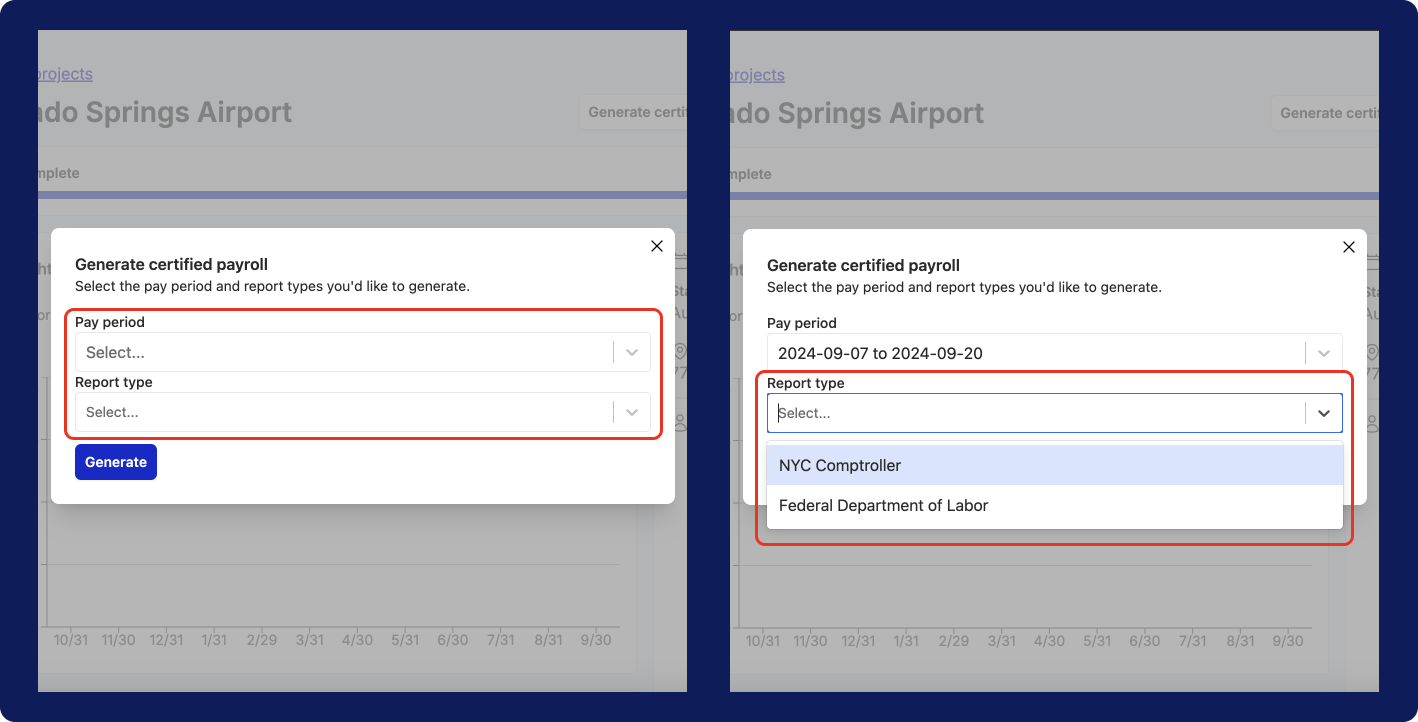

Check to see whether Trayd already provides the form that you need. You can do this by going to the specific project's page, selecting the

Generate certified payrollbutton, and then selecting theReport typedropdown to view all forms that are already on Trayd. -

If the specific form you need is not listed, then you will have to request the form from the general contractor or administrator who is managing the project. Make sure the form is a dynamic PDF.

- Please gather all project-specific information required for the certified payroll form and share these data points with Trayd. Note that we only track payroll data and do not capture project-specific details (e.g., project contract number, wage decision number, etc.).

Process

Set up your project for certified payroll

Before generating a certified payroll report on Trayd, you will need to complete the following items:

- Create a project on Trayd for the job site that is a public work or government-funded construction

- Make sure to select the project when using the scheduling feature or time-tracking feature.

- If you are using the Schedule on Trayd, then you should make sure to select the relevant project when creating shifts.

- If your workers are clocking in/out on Trayd mobile, then make sure they are selecting the project when clocking in their hours.

- When running payroll, make sure all hours worked on the project are assigned to the project when updating payroll on the “Edit shifts” page.

If you have attributed all hours in payroll to the project, then you are all set to begin generating certified payroll reports for your project.

Generate the certified payroll report

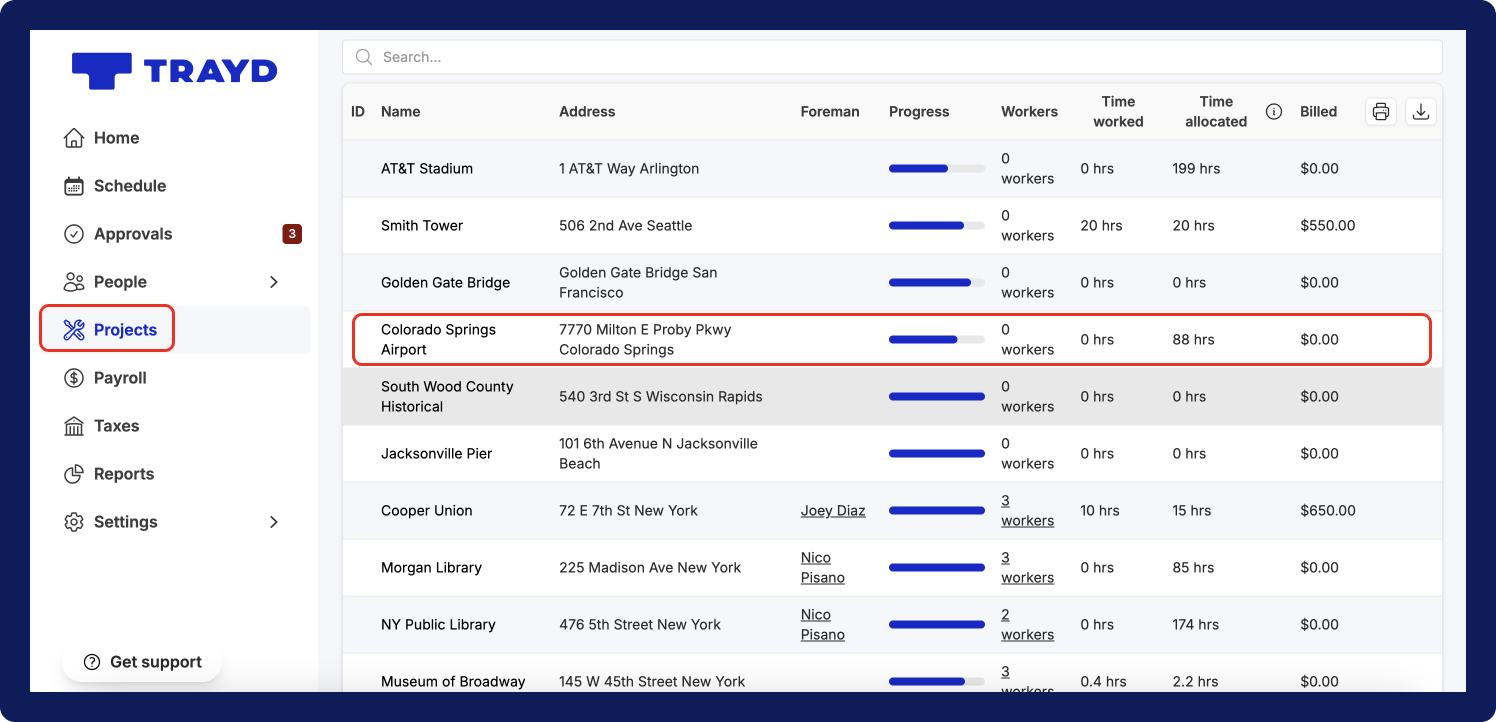

- Select the

Projectsoption on the left-side navigation bar. - In the Projects table, click on the relevant Project row.

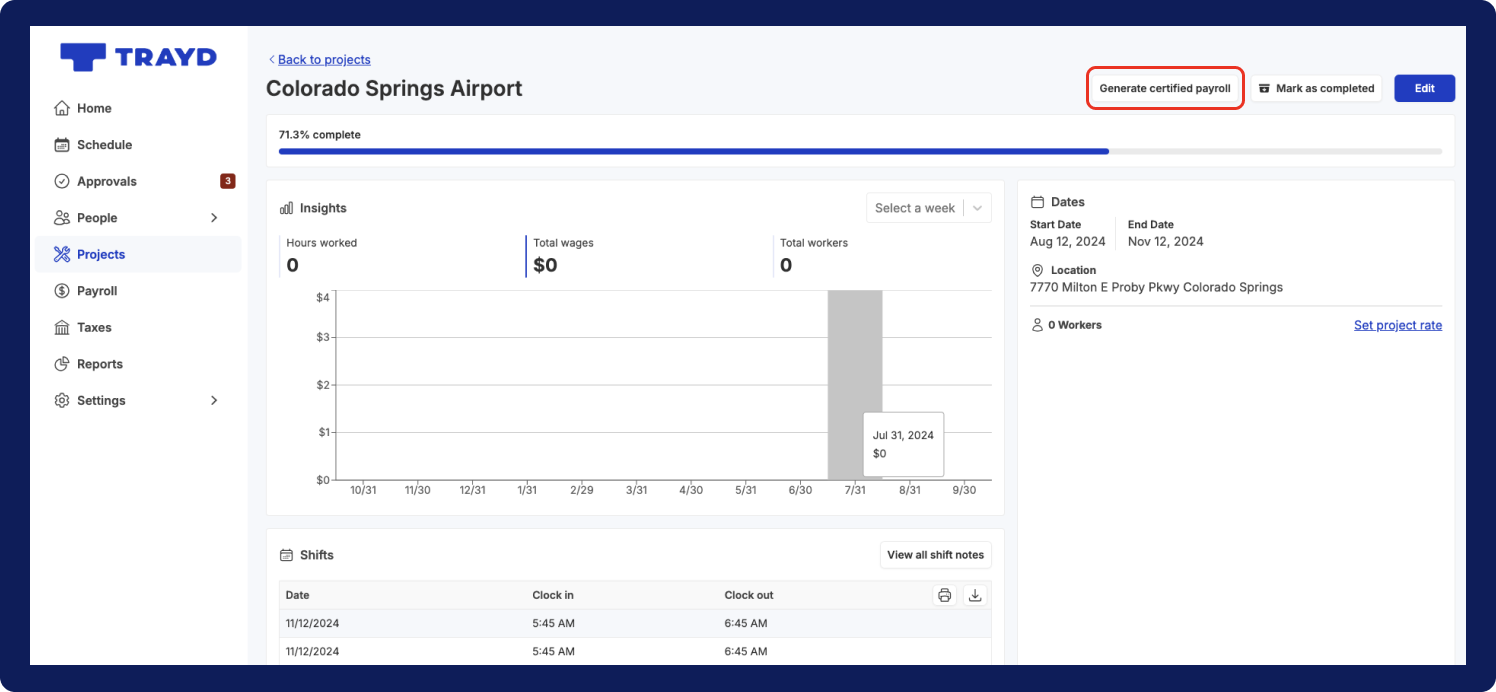

- On the view project screen, click the

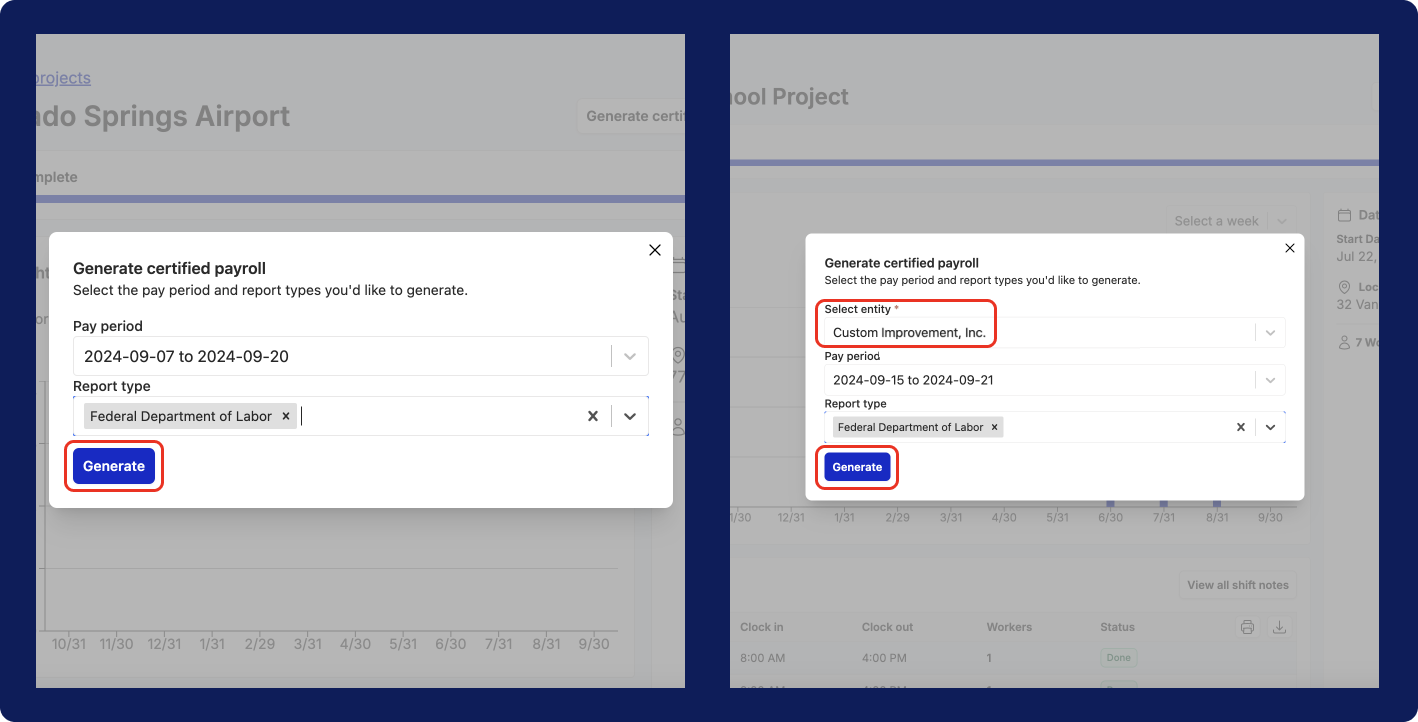

Generate certified payrollbutton.

- The “Generate certified payroll” modal will display. Make sure the select the “Pay period” and “Report type” that you need to submit.

- Once you’re ready, click the

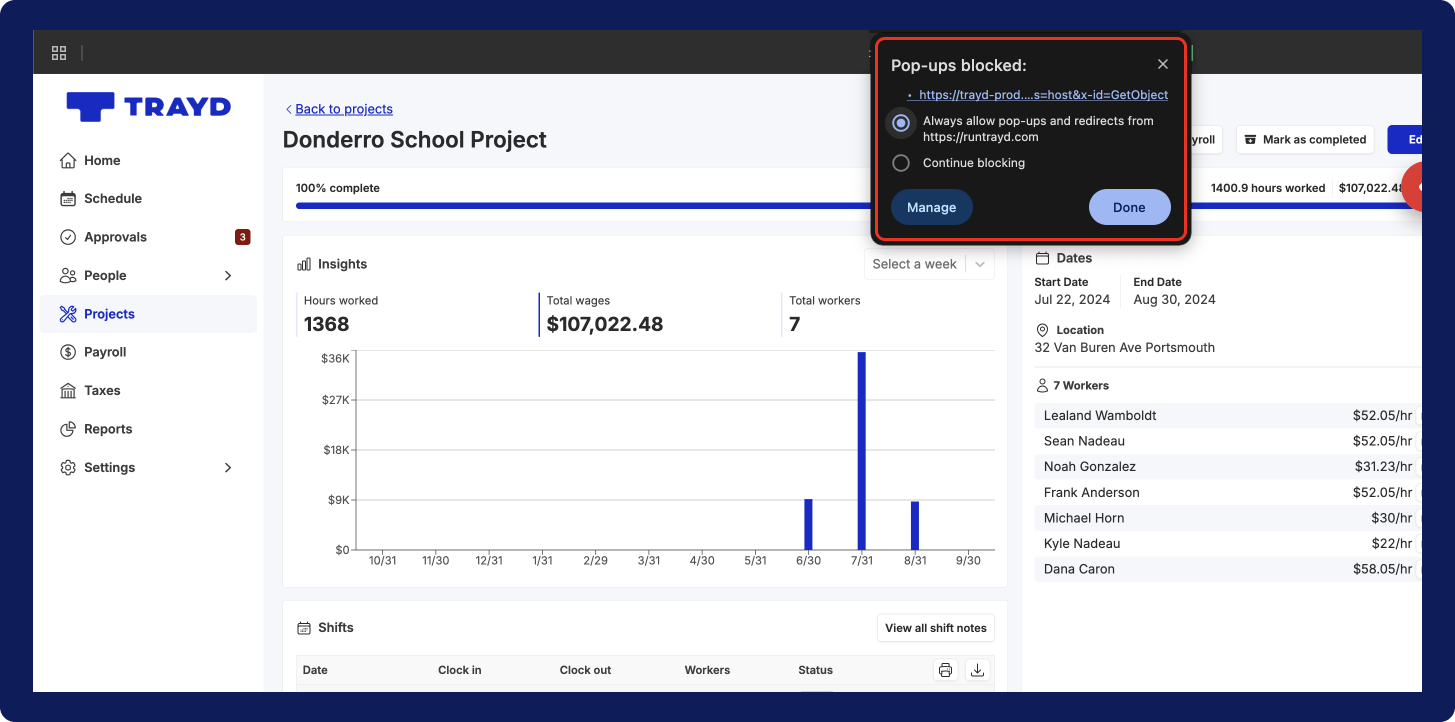

Generatebutton.

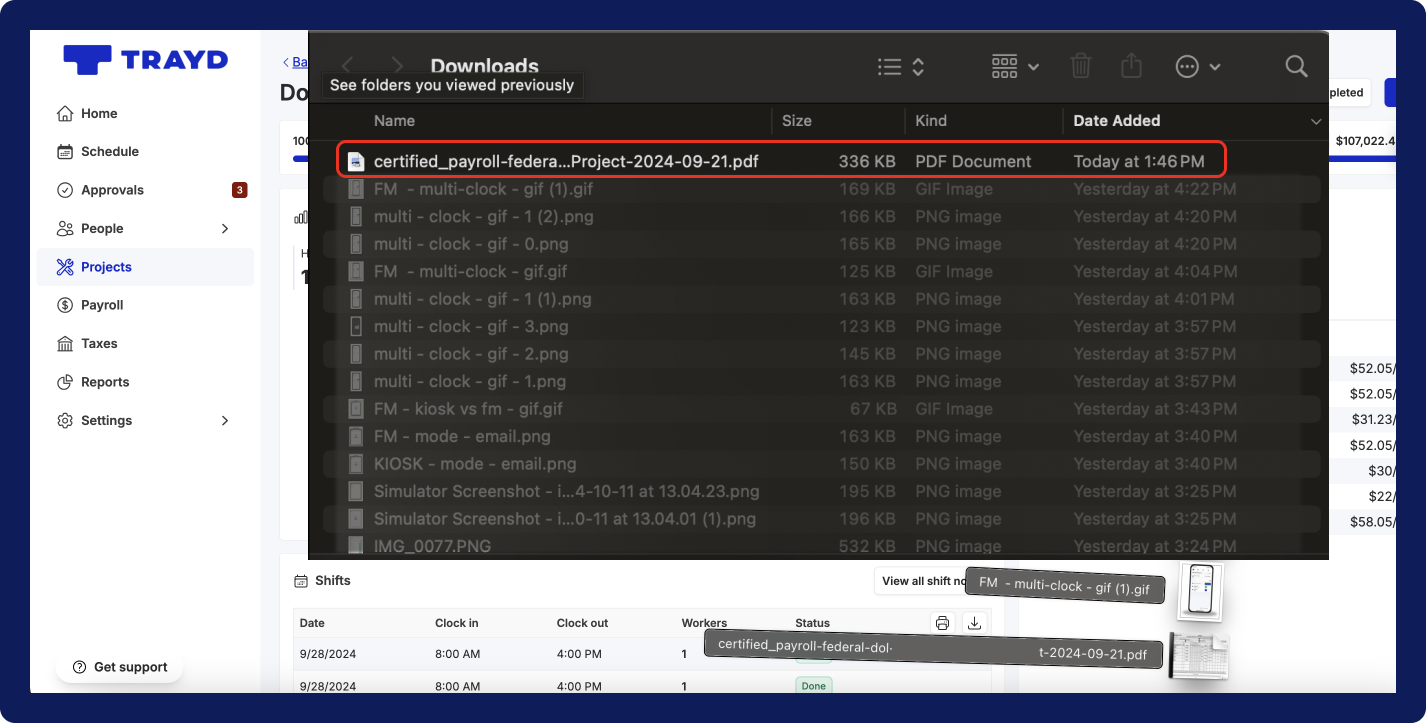

- All set! Go to your device’s “Downloads” folder to find the certified payroll report.