How to: add a deduction for an employee

Tags: Payroll, People, Process, Subcontractors

Overview

A post-tax deduction is an amount subtracted from an employee's gross pay after taxes have been calculated and withheld.

Post-tax deductions can only be set up at the employee-level. There are no company-level post-tax deduction setup options.

Process

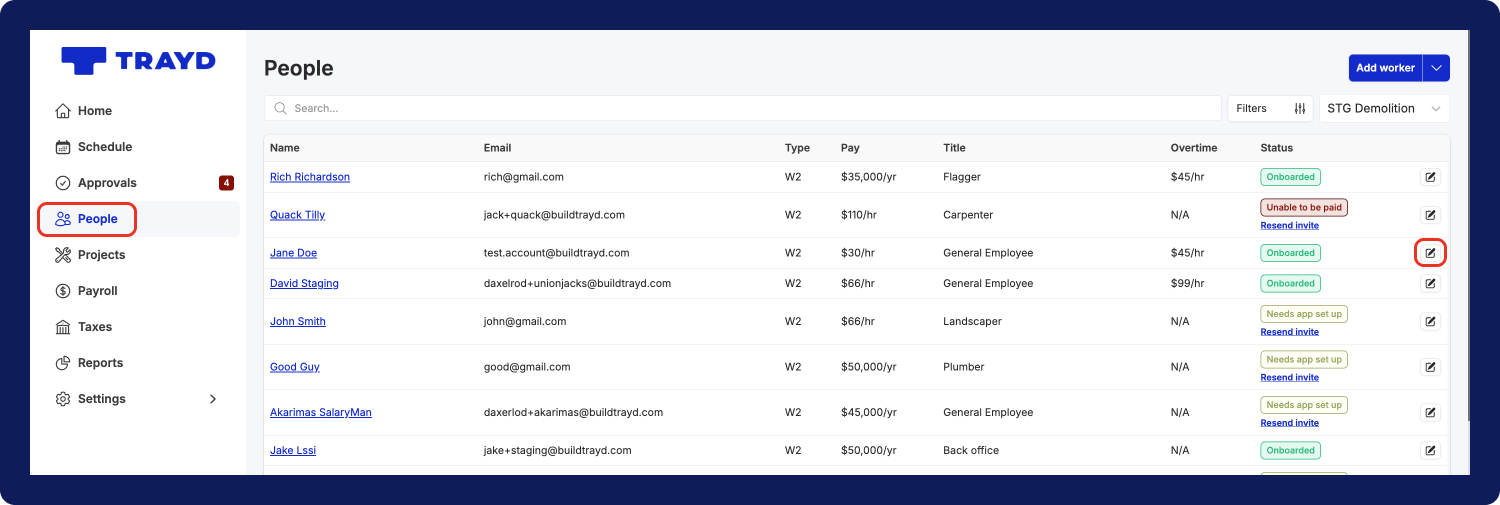

- Select the

Peopleoption on the left side navigation bar. - On the “People” page, click on the edit

🖊button on the far right side of the employee you would like to add deductions for.

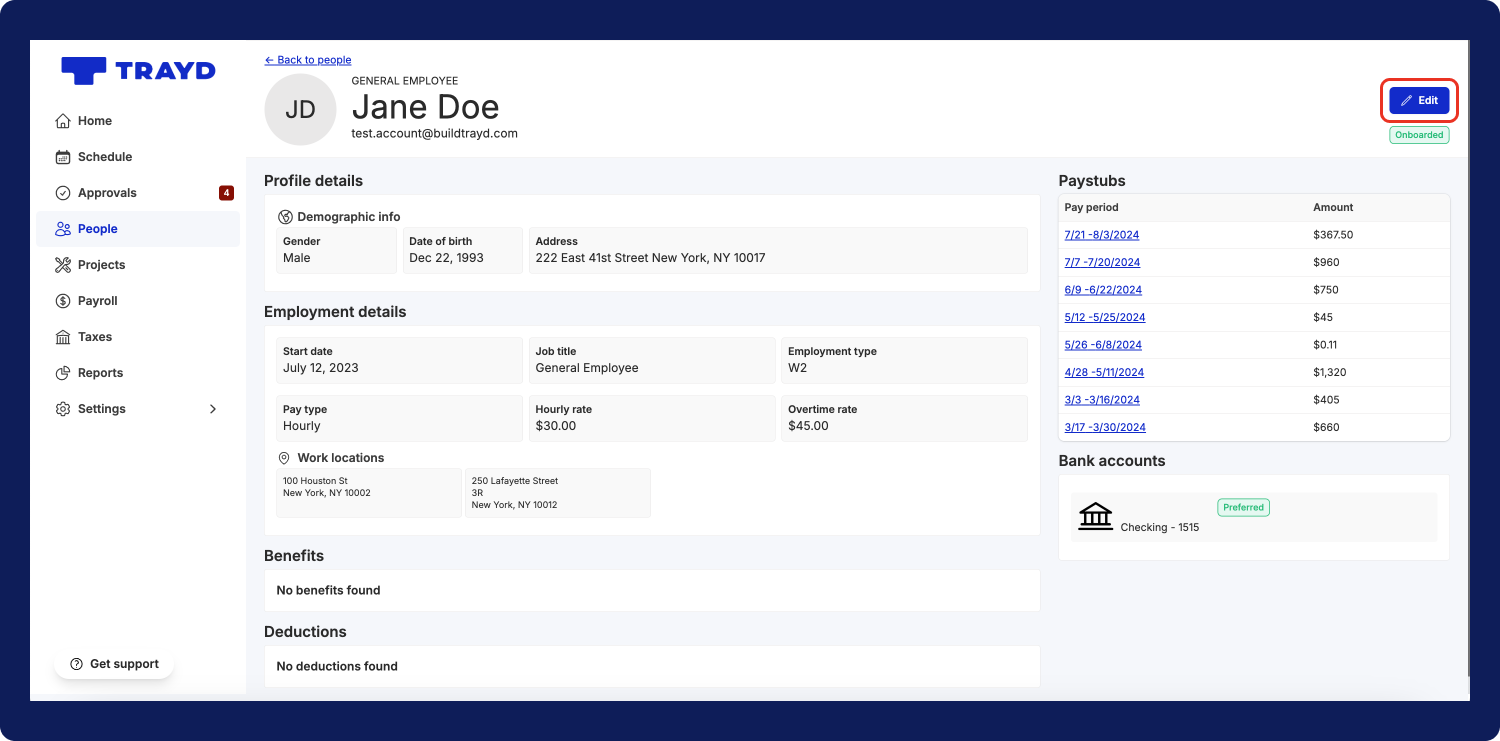

- On the employee’s page, select the

🖊 Editbutton on the top right corner.

- You’ll see the “Edit Employee” modal open up. Click the

+ Add deductionoption on the bottom right corner. - On the new deduction line item, input all the relevant details for the deduction: description, type (% or $), amount, and total amount.

- Once you’re done adding all the deductions for the employee, click the

Savebutton.

- All set! You have now added deductions for the employee and will see them listed in “Deductions” section of their profile.