How to: add a work location for my company

Tags: Process, Subcontractors, Tax

Overview

Accurately documenting the primary work location is crucial for proper tax administration and regulatory compliance.

Work location affects state and local taxation, as well as compliance with employment laws specific to that location. Even if an employee works in a different state for a short period, it may still impact tax withholding and reporting requirements.

Process

- Click the

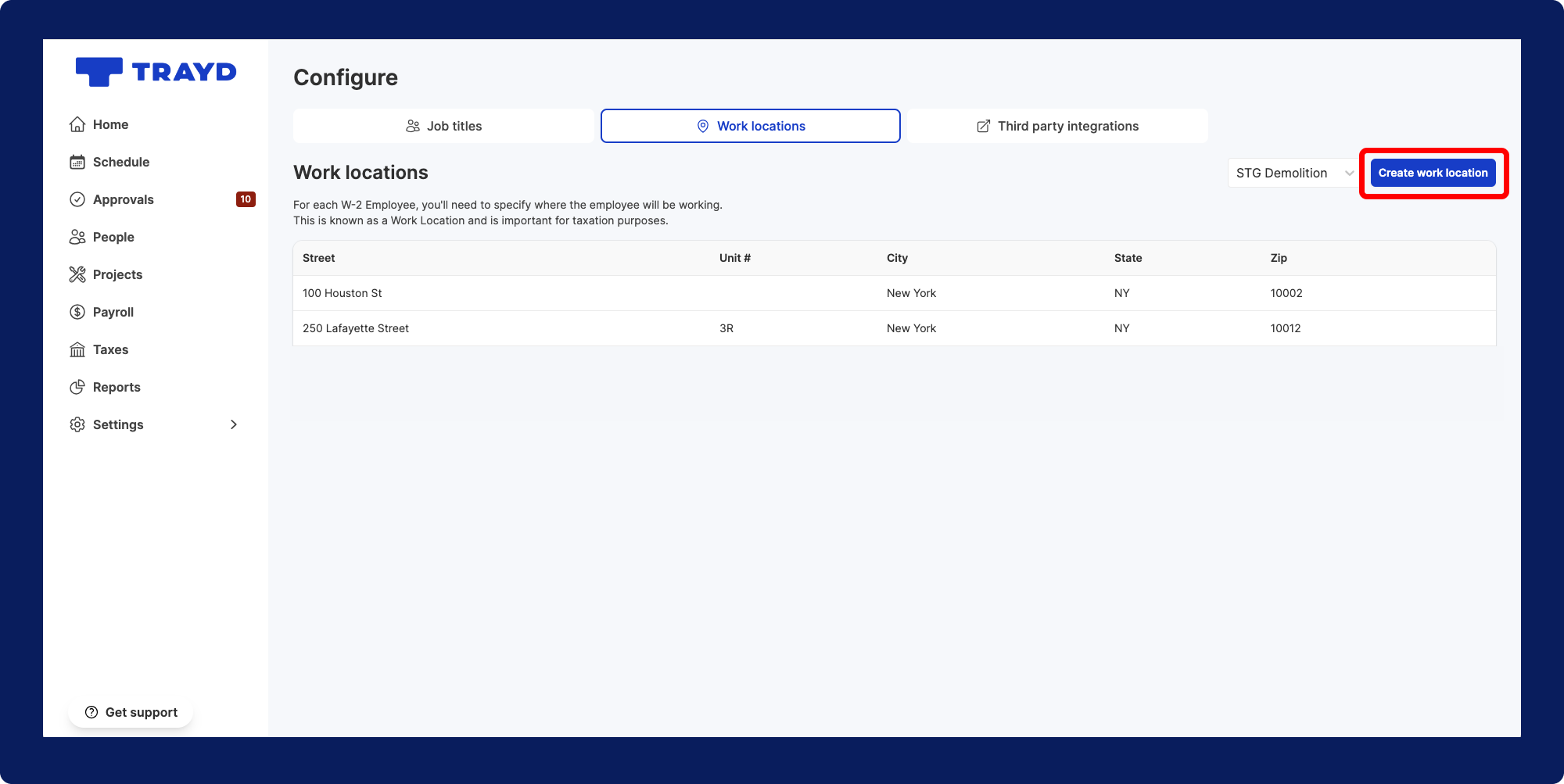

Settingsoptions on the left side navigation bar. Then, click on theConfigureoption under “Settings” - Once you are on the “Settings” screen, click on the

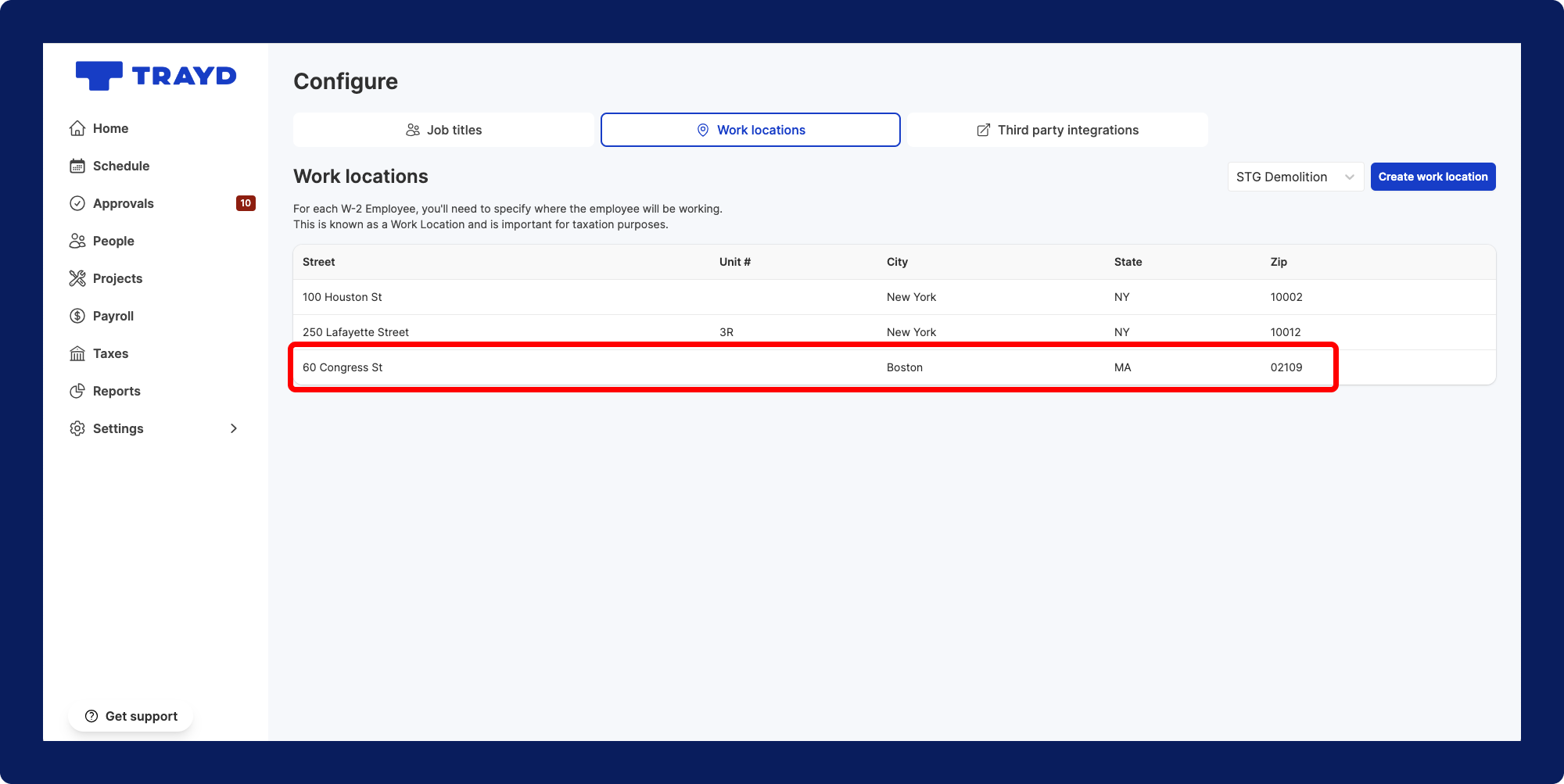

Work locationstab listed on the top of the page. Then, click on theCreate work locationbutton.

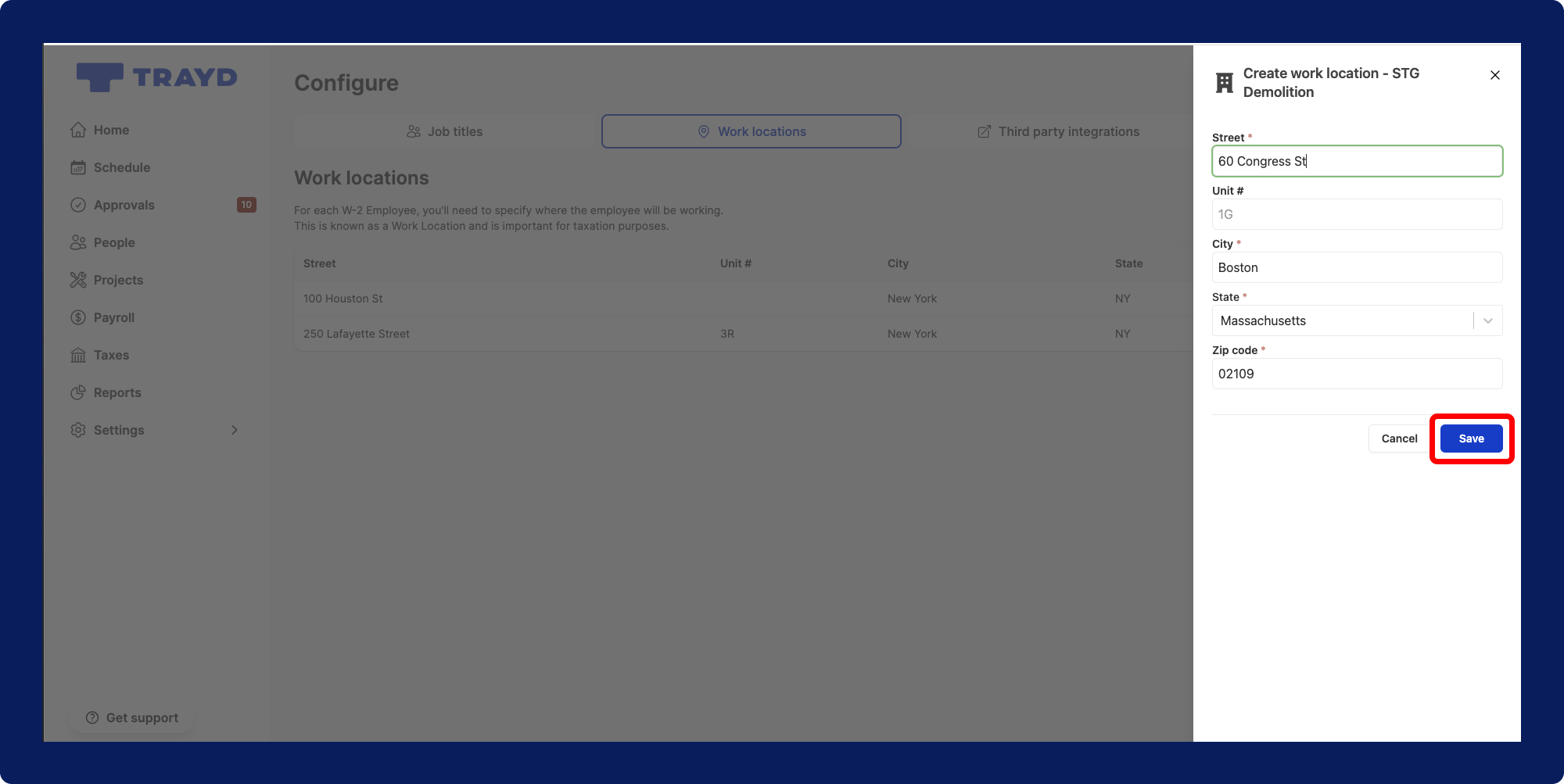

- In the “Create work location” right-side drawer, fill out all the relevant fields for the new work location. When you’re done, click the

Savebutton.

- On the left side navigation bar, click the

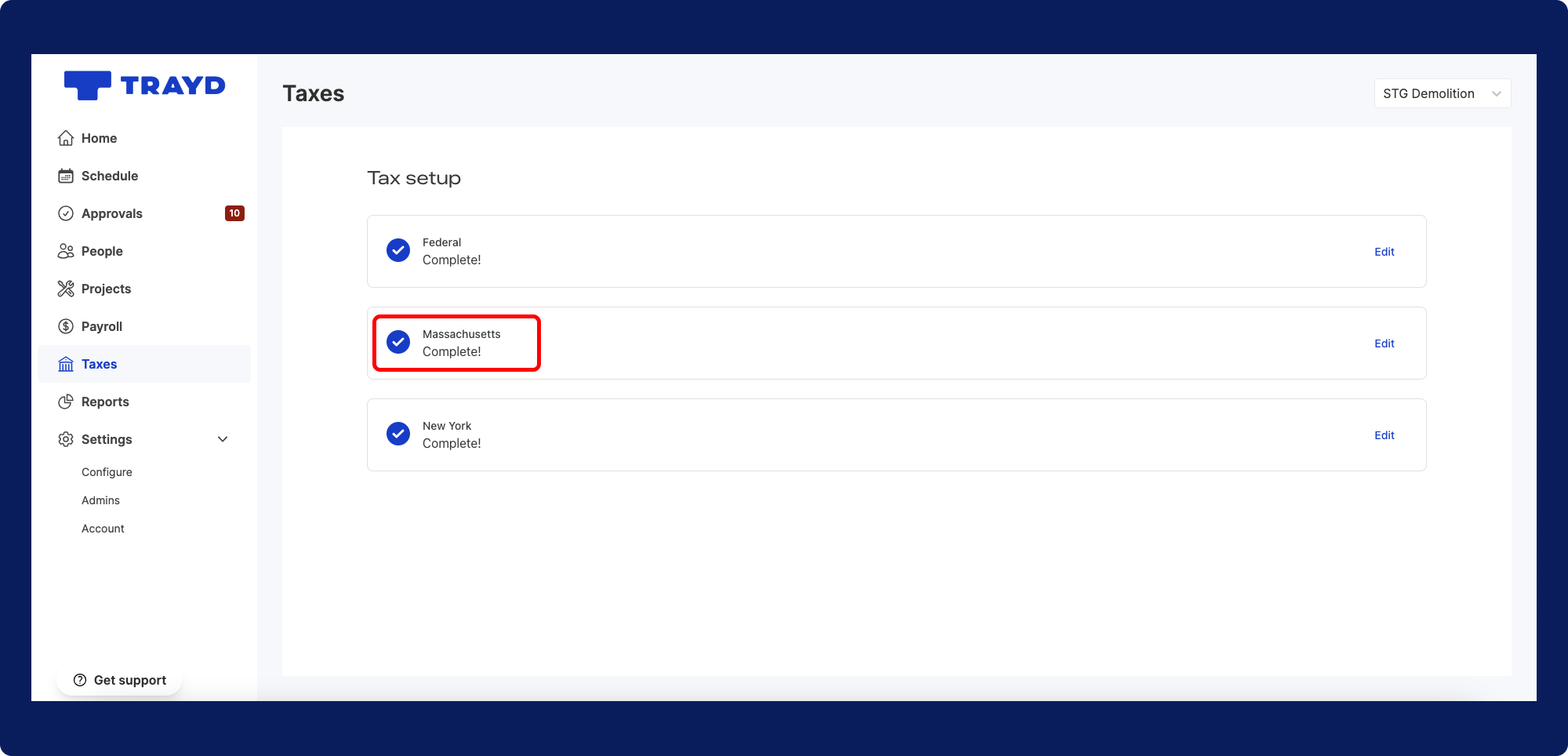

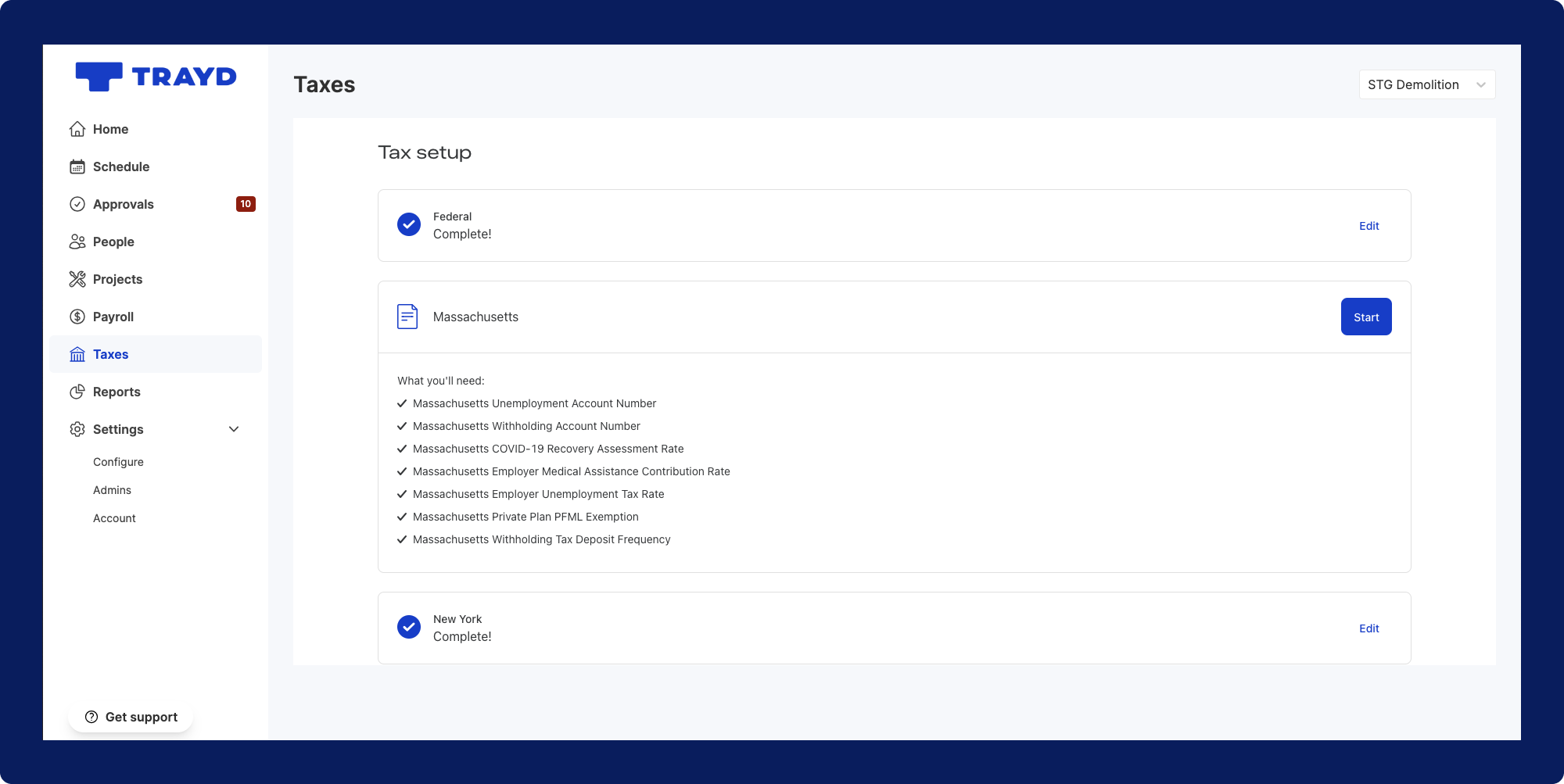

Taxesoption. Here, you will see the new location’s state along with a list of the relevant information needed to complete the tax setup. When you’re ready to begin, click theStartbutton.

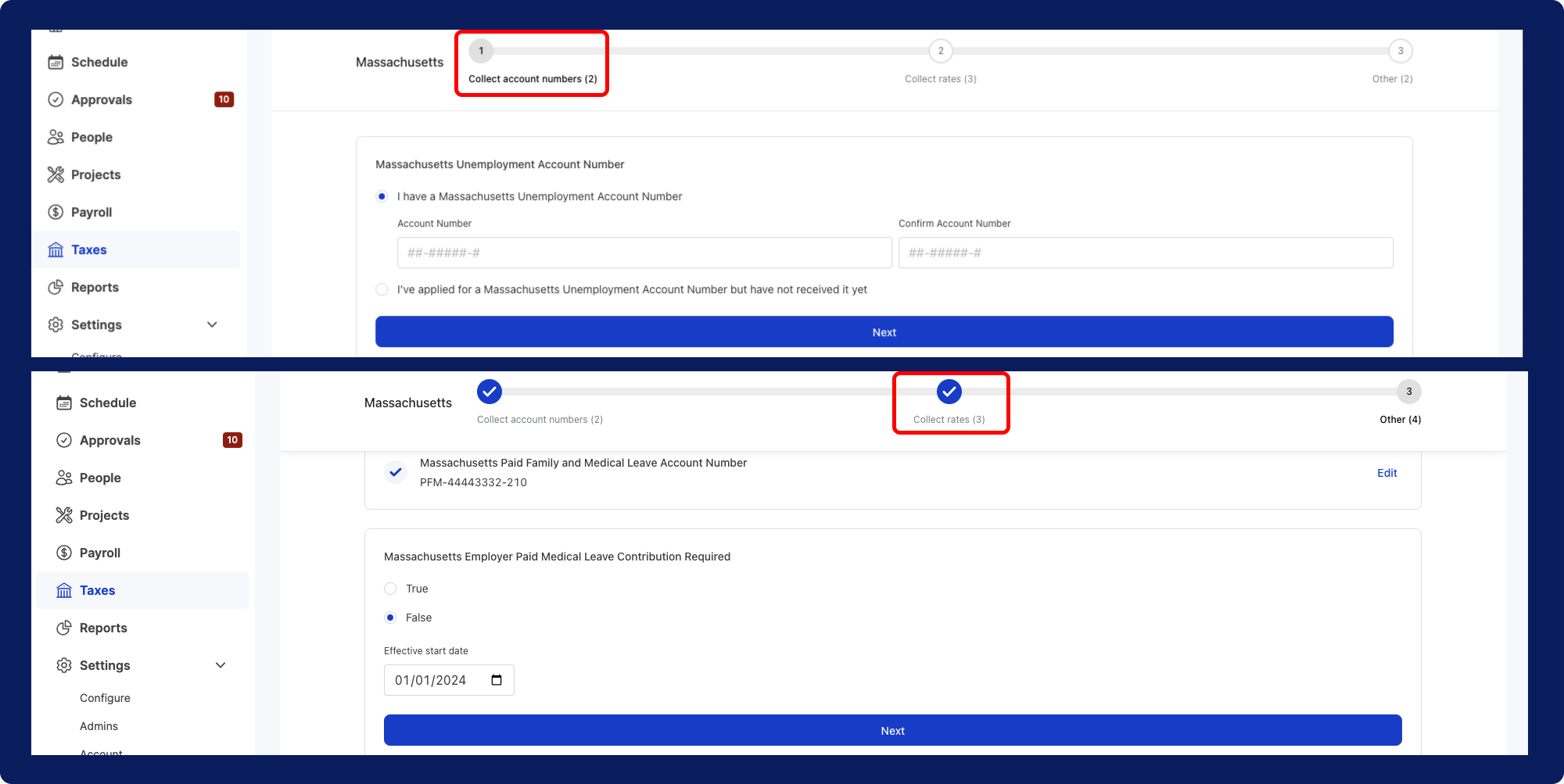

- Make sure to accurately fill out all the required fields when completing the tax setup.

- After completing all the required fields, click on the

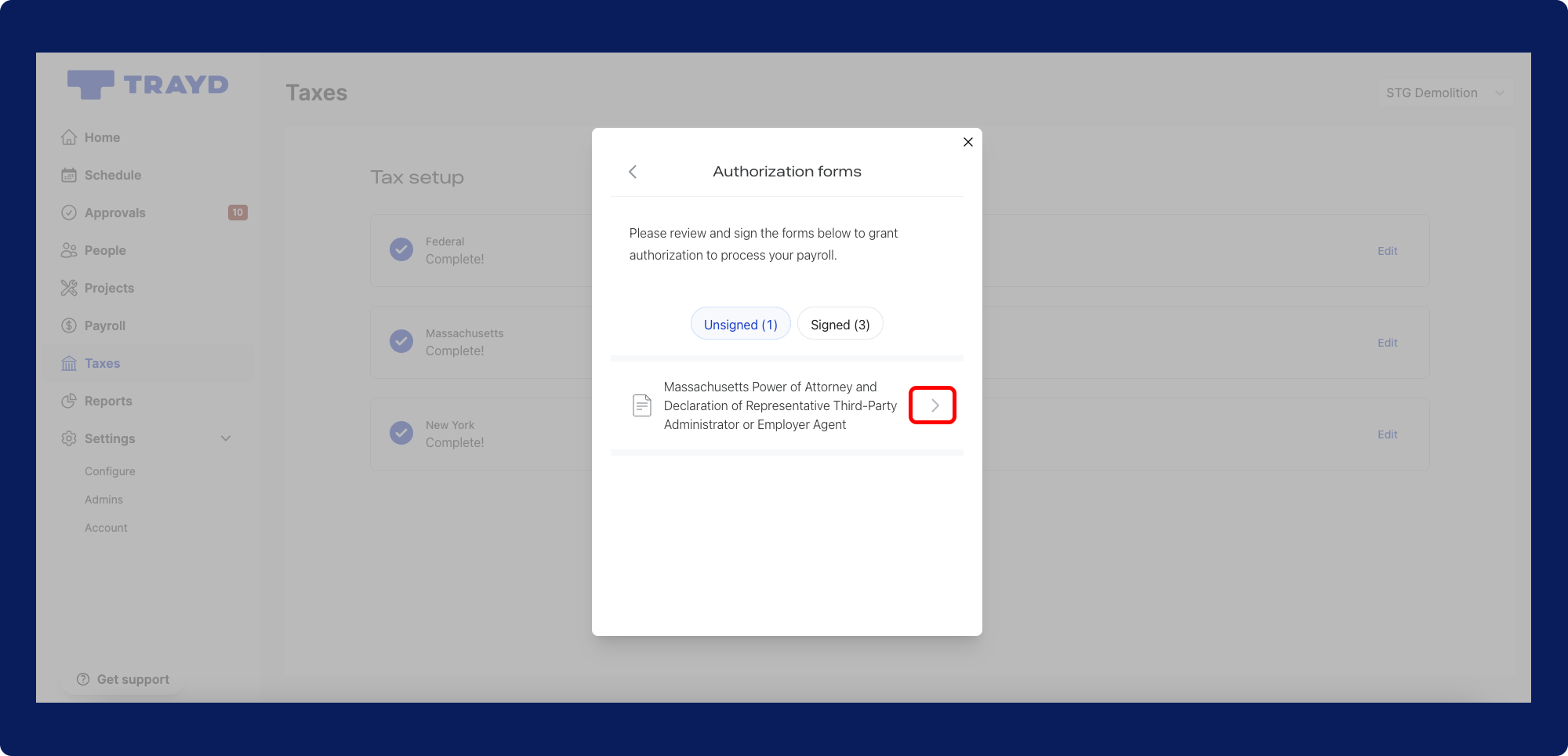

>button next to the Authorization form to sign it.

All done! On the “Tax setup” page you will see the new state has a status of “Complete”