How to: add different earning types for payroll

Tags: Payroll, Process, Subcontractors

Overview

This article provides a comprehensive guide to adding various earning types to payroll for your team. Adding different earnings helps tailor pay to each employee's work conditions and ensures accurate pay allocation.

This includes setting up distinct pay types like overtime, time off, and wages that apply to specific projects or roles. Here, you'll learn how to:

- Allocate double overtime for employees who work beyond standard hours.

- Add paid time off (PTO) entries to track vacation or personal leave.

- Include sick days to record time taken off for illness.

- Assign holiday pay for official non-working days.

- Set prevailing wage rates for specific projects where these requirements apply.

Following the steps below will help you customize earnings in payroll, ensuring that pay calculations reflect each unique work scenario accurately and efficiently.

Process

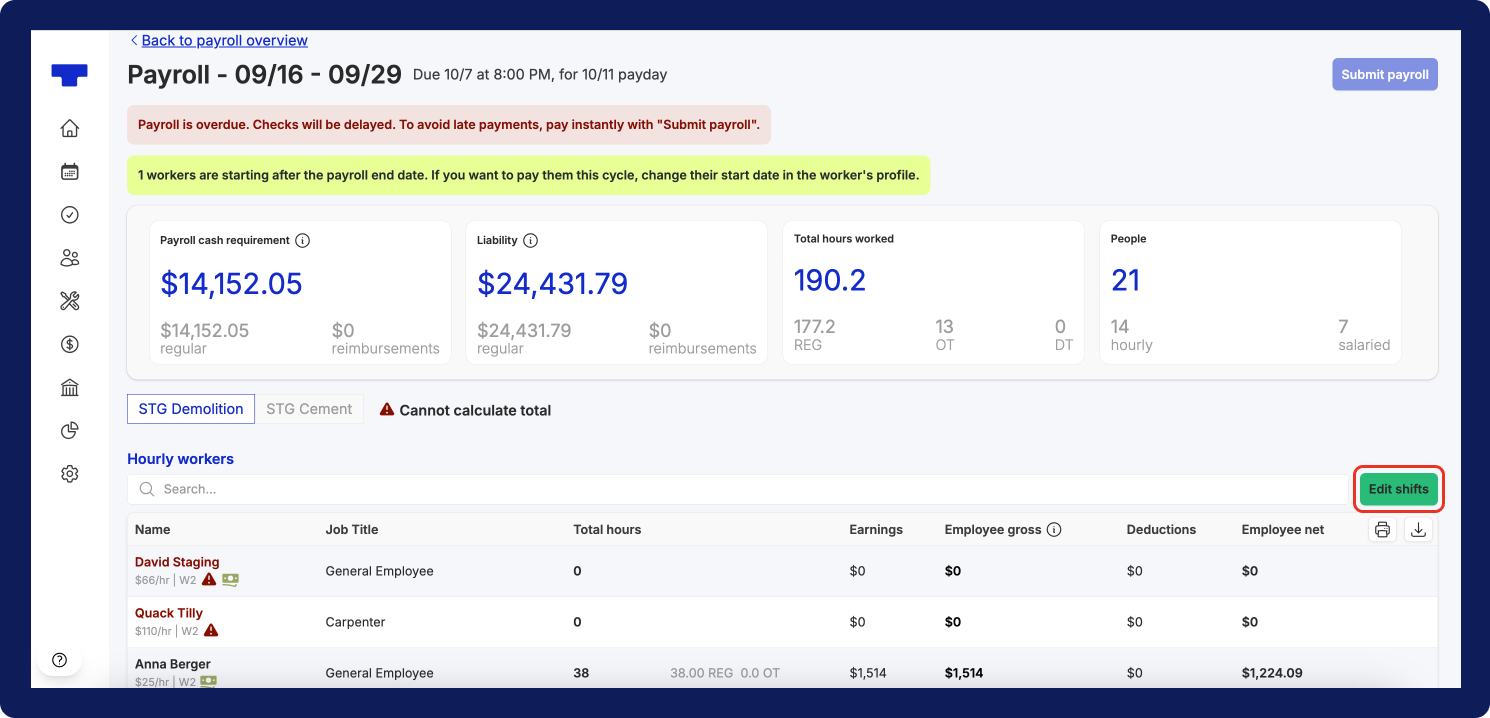

- Navigate to the Payroll page and select the pay period you would like to update. From the View Payroll screen, click the

Edit shiftsbutton.

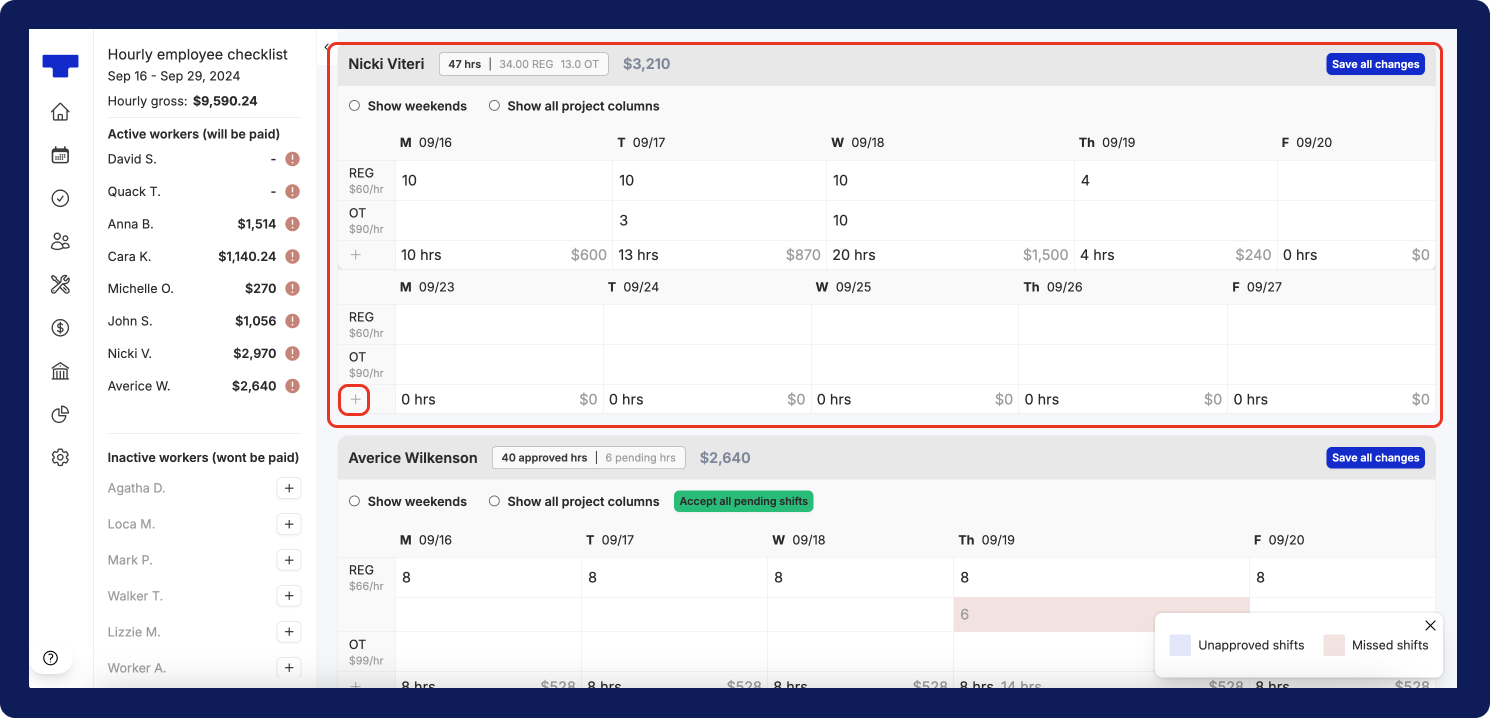

- On the Edit screen, go to the person’s table that you would like to update. In the table, click

+button for the week you would like to allocate a different earning type or rate.

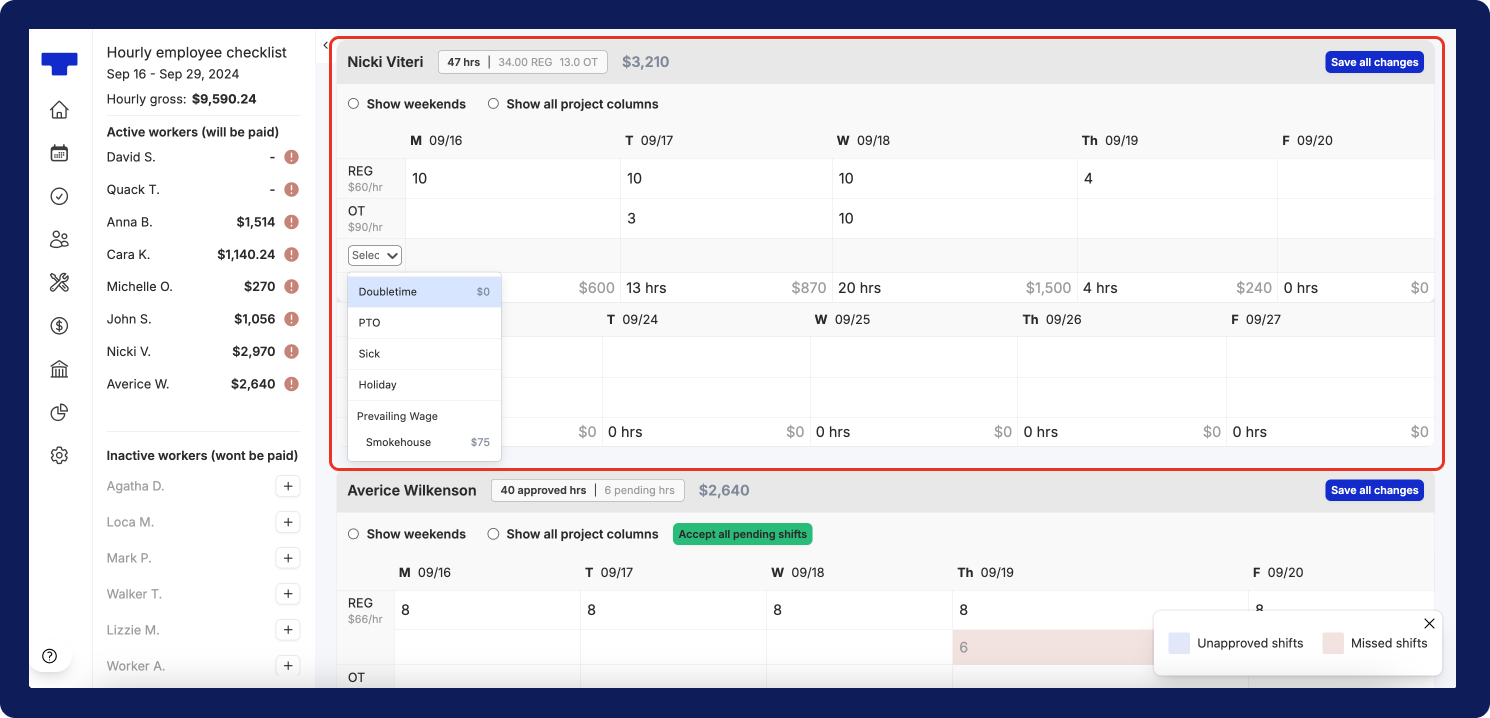

- After selecting the add button, you’ll see a drop-down of options available to you. If the employee has prevailing wage, then you will this at the bottom, with a list of the projects where they earn prevailing wage.

- Select the earning type or rate that you would like to apply.

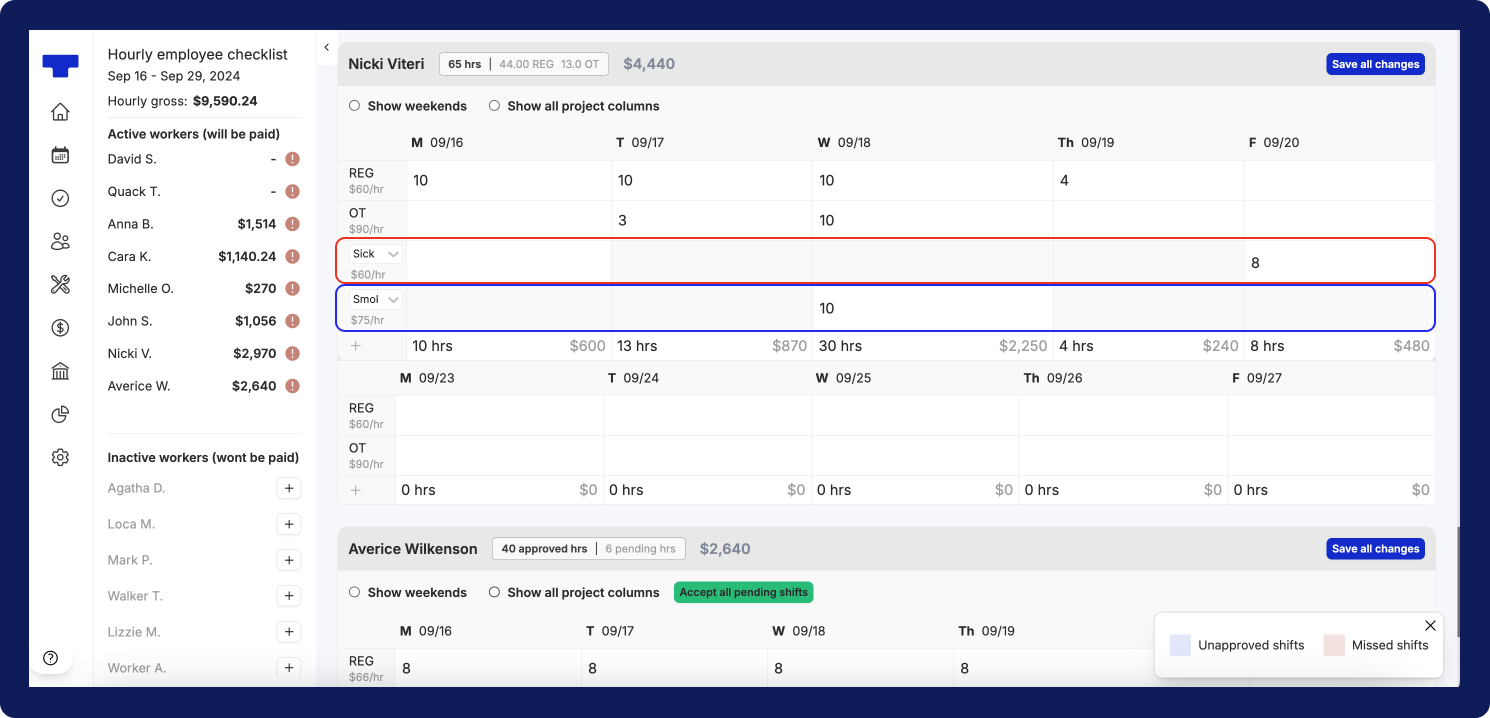

- You’ll see a new row displayed at the bottom of the table. Now, add the hours you would like to allocate for the different earning type.

- If you would like to add additional earning types, simply follow steps 2- 5 again. Remember to click the

Save all changesbutton when you are done updating the hours for the employee

All set! You’ve applied a different earning type for an employee’s payroll run.