How to: update my tax forms (W-4, W-9, etc…)

Tags: Process, Tax, Workers

Overview

W-4 Form: Employees fill out this form when they start a new job. It helps their employer know how much federal tax to take out of each paycheck based on their personal situation (like if they’re married or have kids). This way, employees don’t pay too much or too little in taxes throughout the year.

W-9 Form: Independent contractors and freelancers fill out this form when they’re hired by a company. It provides the company with their tax ID number, which is needed for tax reporting. At the end of the year, the company uses this information to report how much they paid the contractor so they can file their taxes correctly.

State Withholding Forms: Many states have their own version of the W-4. Employees complete these when starting a job or updating their tax info, which helps employers know how much state tax to withhold from their paychecks. Like the federal W-4, these forms let employees specify their filing status and withholding preferences, ensuring the right amount of state tax is withheld.

- Examples:

- California: DE-4 (Employee’s Withholding Allowance Certificate)

- New York: IT-2104 (Employee’s Withholding Allowance Certificate)

- Illinois: IL-W-4 (Employee’s Withholding Allowance Certificate)

Process

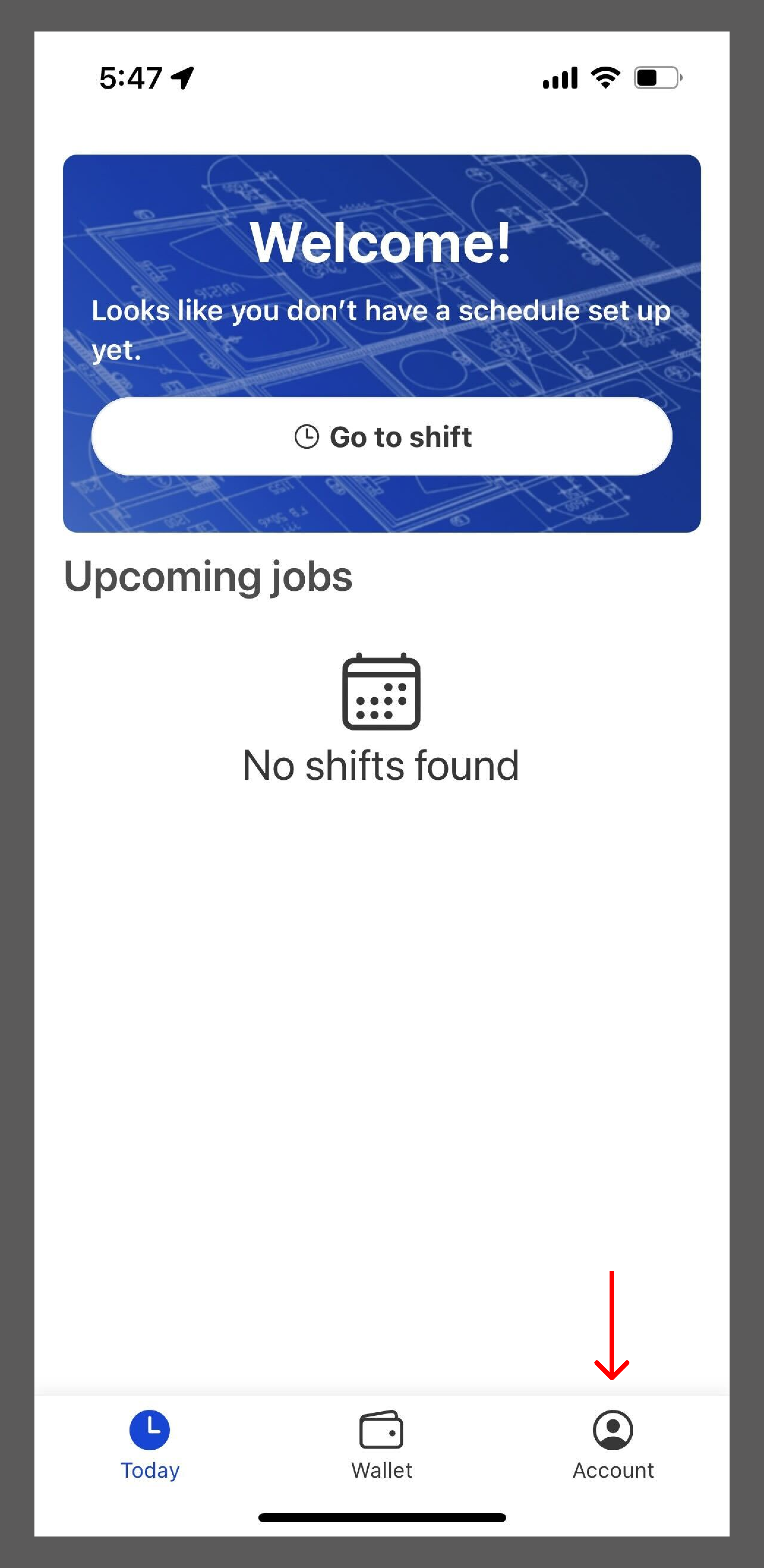

- On your mobile app, go to the

Accountoption that is on the far right of the bottom navigation bar.

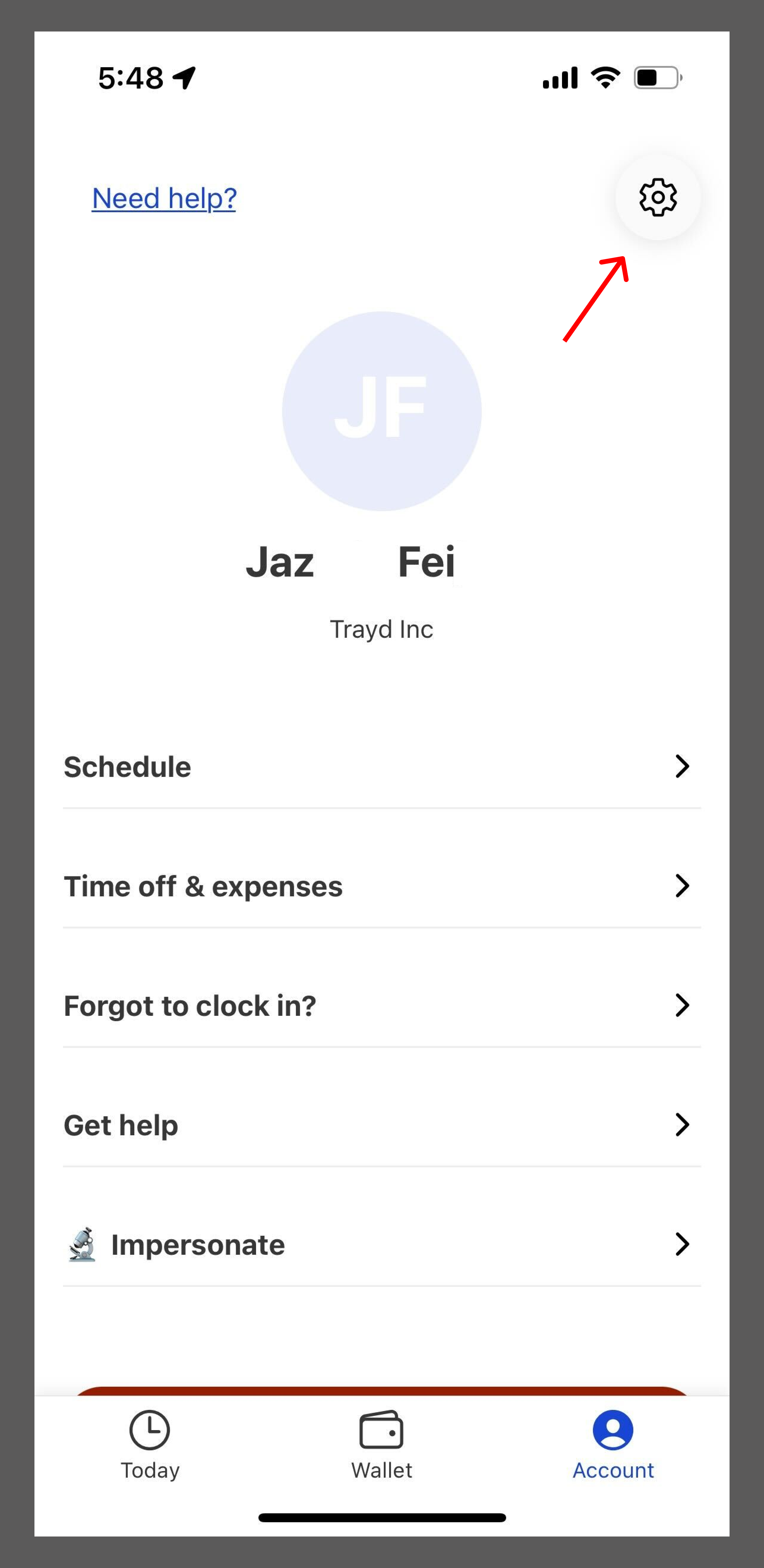

- On the Account screen, click the

Settingsbutton that is on the top right corner. You may have to scroll to the top of the screen to see this button.

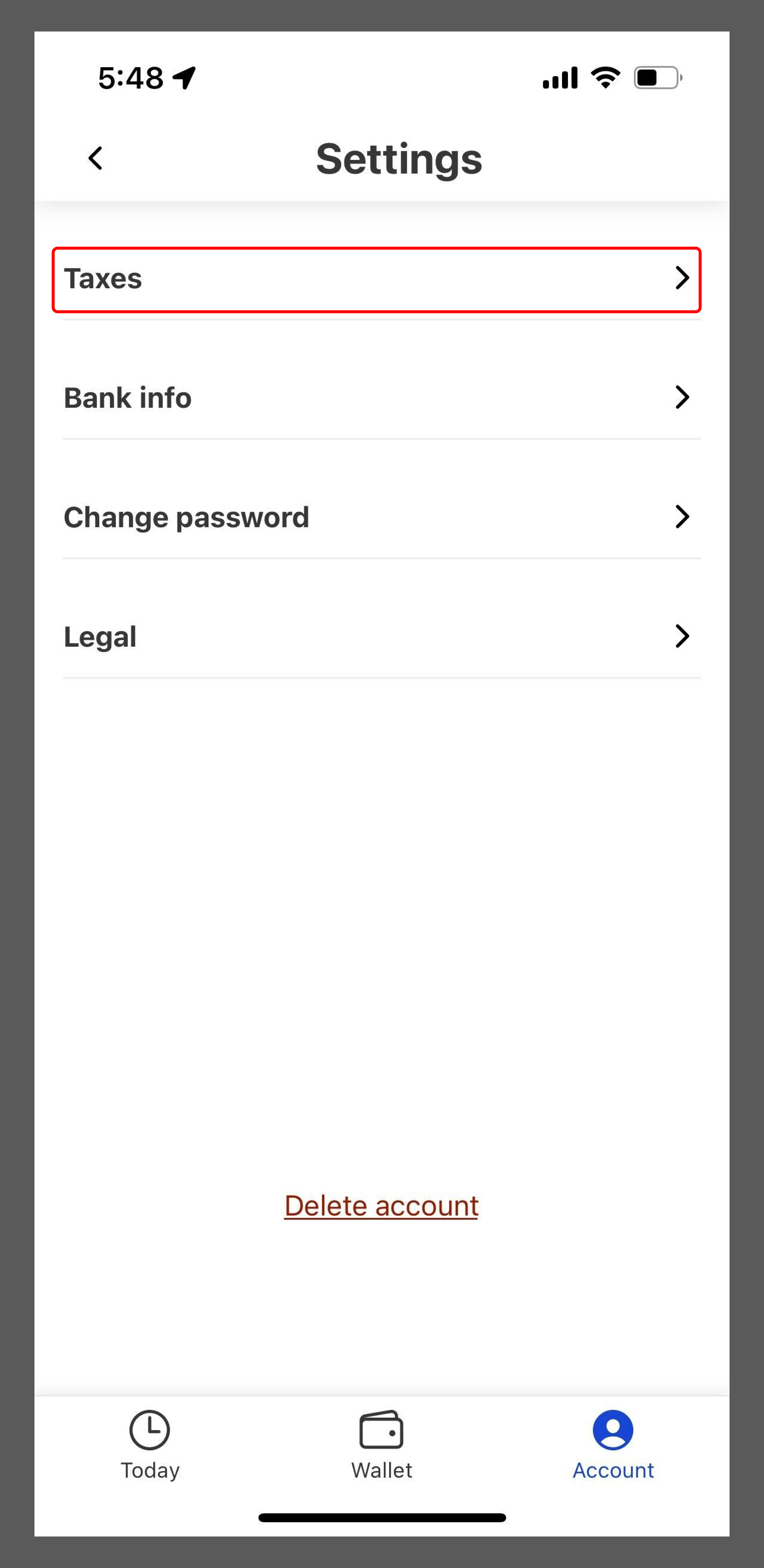

- On the Settings screen, select the

Taxesoption.

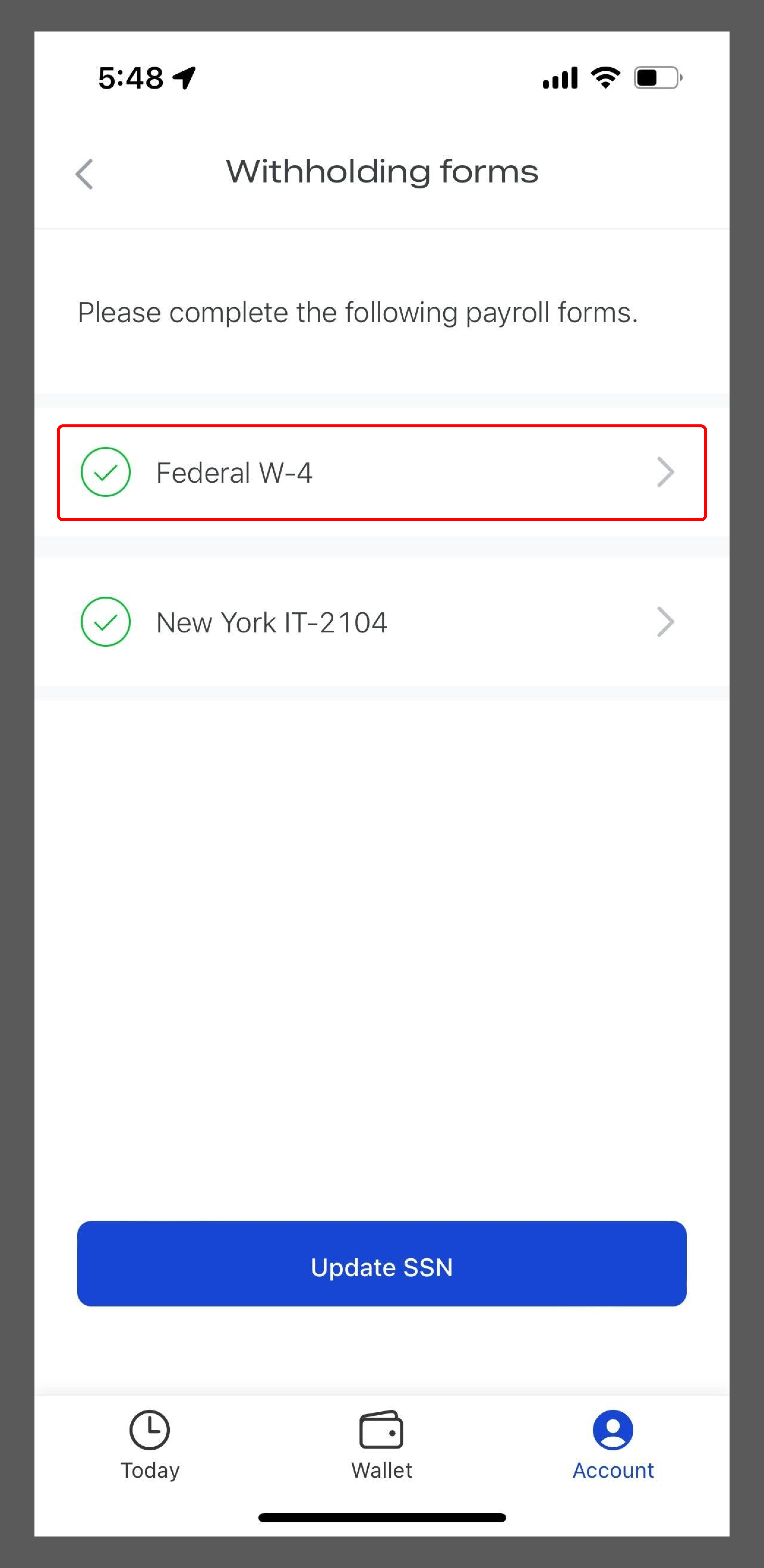

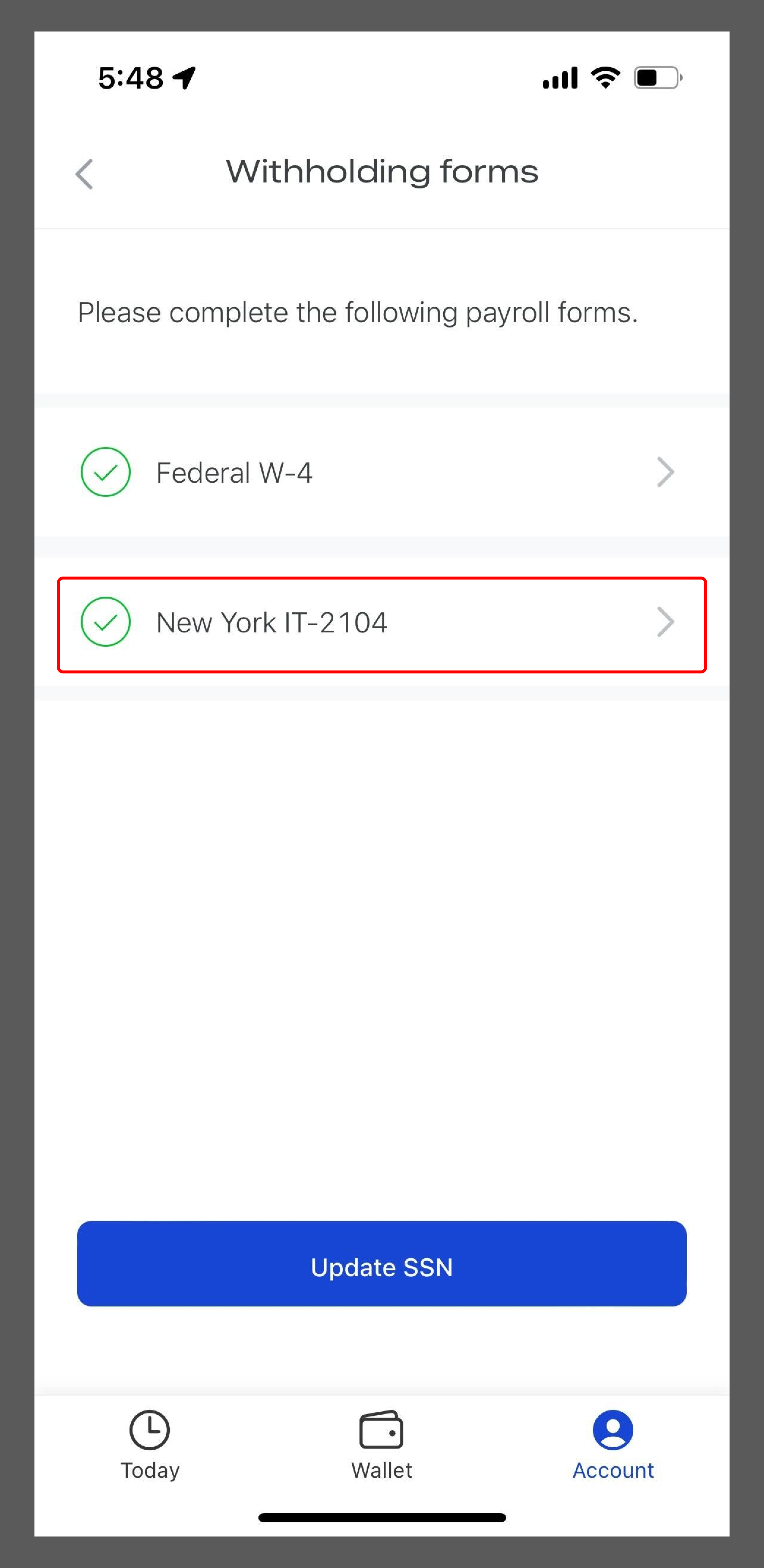

- On the Taxes screen, select the

Federal W-4option that is listed under Withholdings forms.

- Once you are on the Federal W-4 screen, select the

Regenerate Form and Signbutton. This will take you to the screen where you can update your tax information. Make sure to go through all the steps to save your changes.

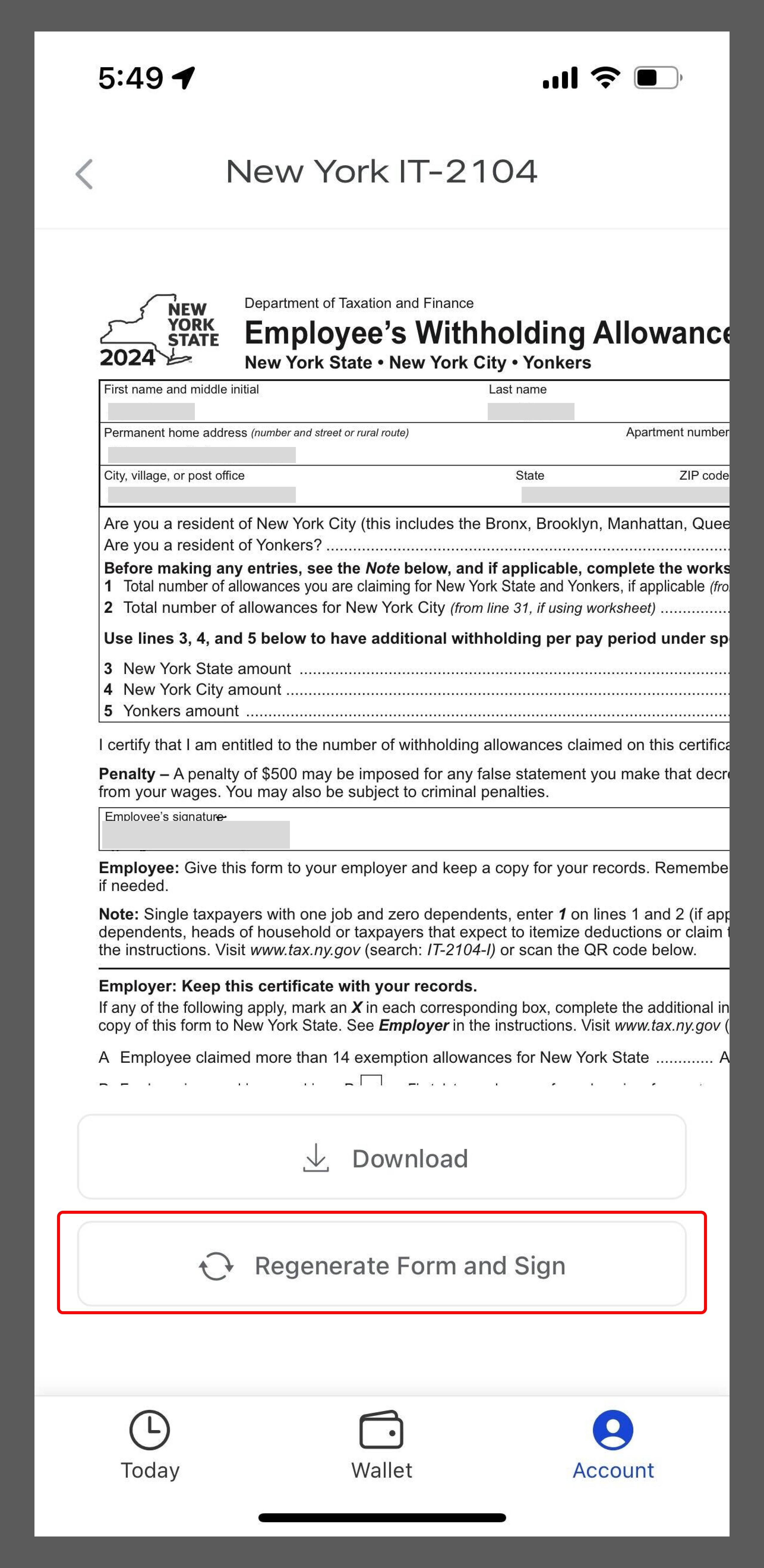

- You will have to do the same for your local taxes. On the Taxes screen, select the option for your local tax forms.

- Select the

Regenerate Form and Signbutton. This will take you to the screen where you can update your local tax information. Make sure to go through all the steps to save your changes.

All set! You have now updated your tax forms.