Getting started: setup my taxes

Tags: Onboarding, Process, Tax, Workers

Overview

Filling out your W-4 tax form and state tax form for your employer is important for several reasons:

- To ensure accurate withholdings so that you pay the correct amount of taxes throughout the year

- To avoid underpayment or overpayment of taxes

- To ensure compliance with state tax regulations

- To ensure you receive state benefits you may be entitled to (i.e. credits for dependents or deductions for specific expenses)

- To avoid state tax liabilities

Process

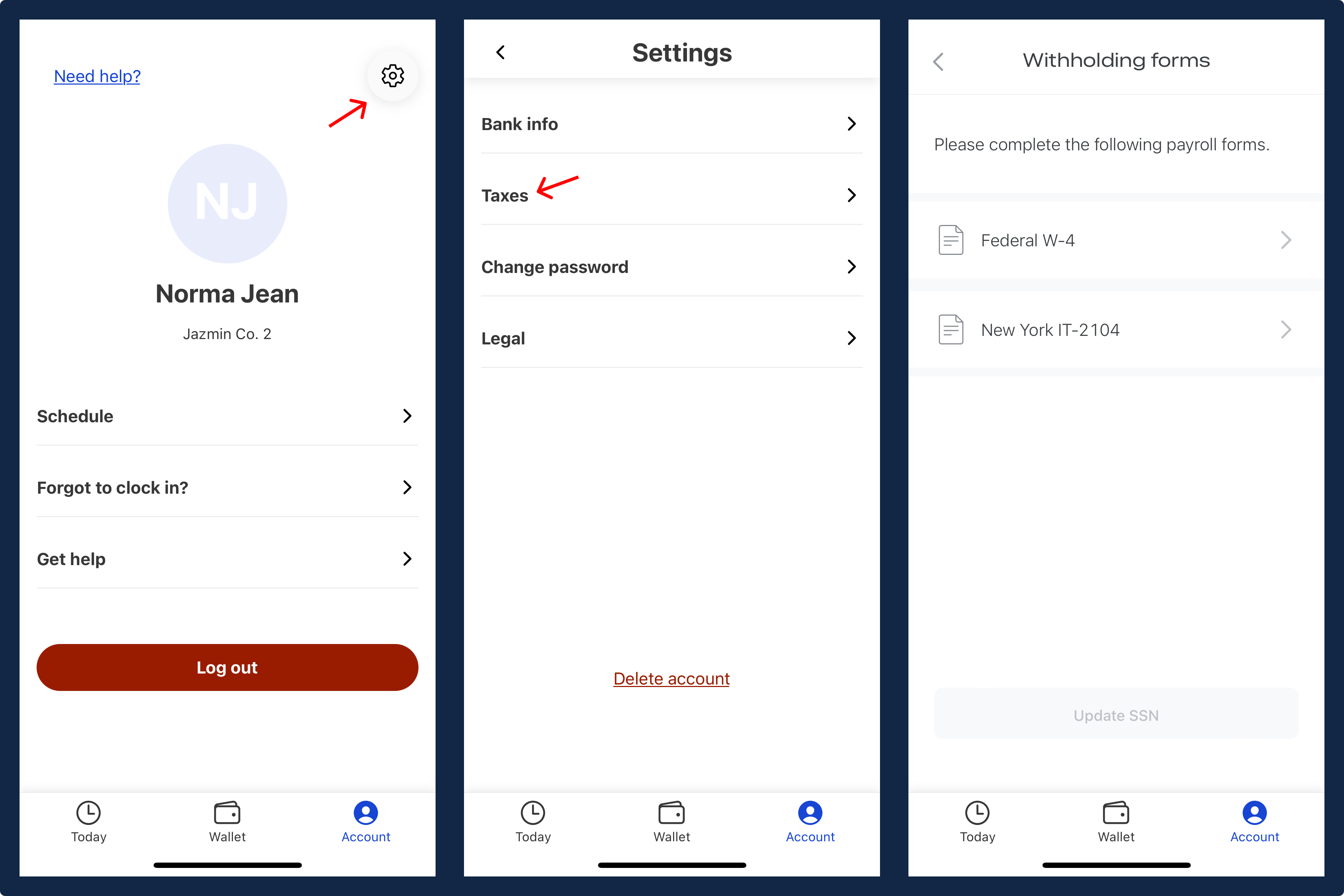

Navigate to tax setup

- Select the “Account” option that is located on the far right side of the bottom navigation bar.

- Then, select the

Settingsbutton that is located on the top right corner of the “Account” screen. - In the “Settings” screen, select the “Taxes” option listed below.

- Once you are on the “Taxes” screen, you will see 2 options: one for your Federal W-4 tax form and one for your state tax form (i.e. For New York this will be your IT-2104 tax form)

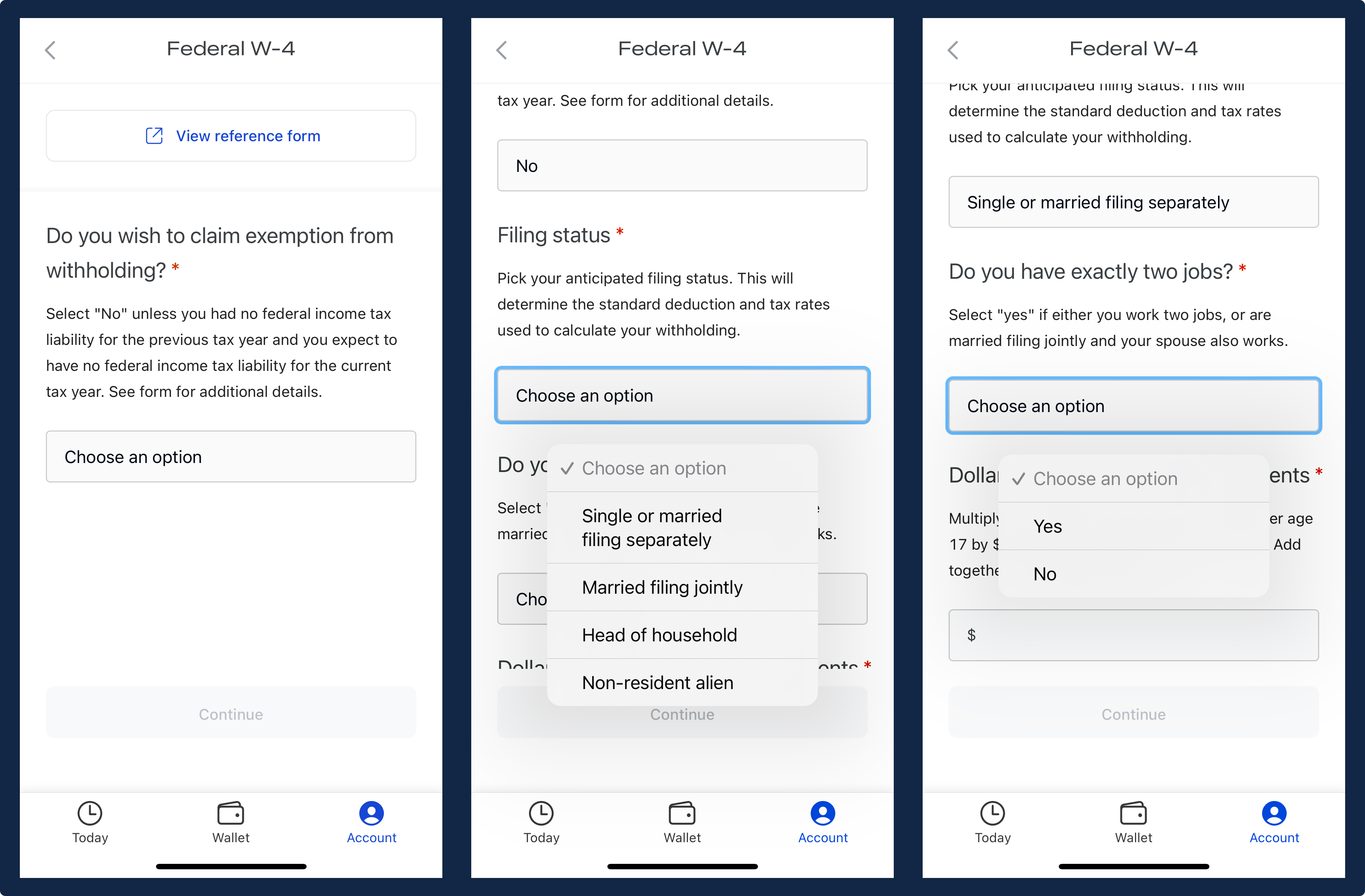

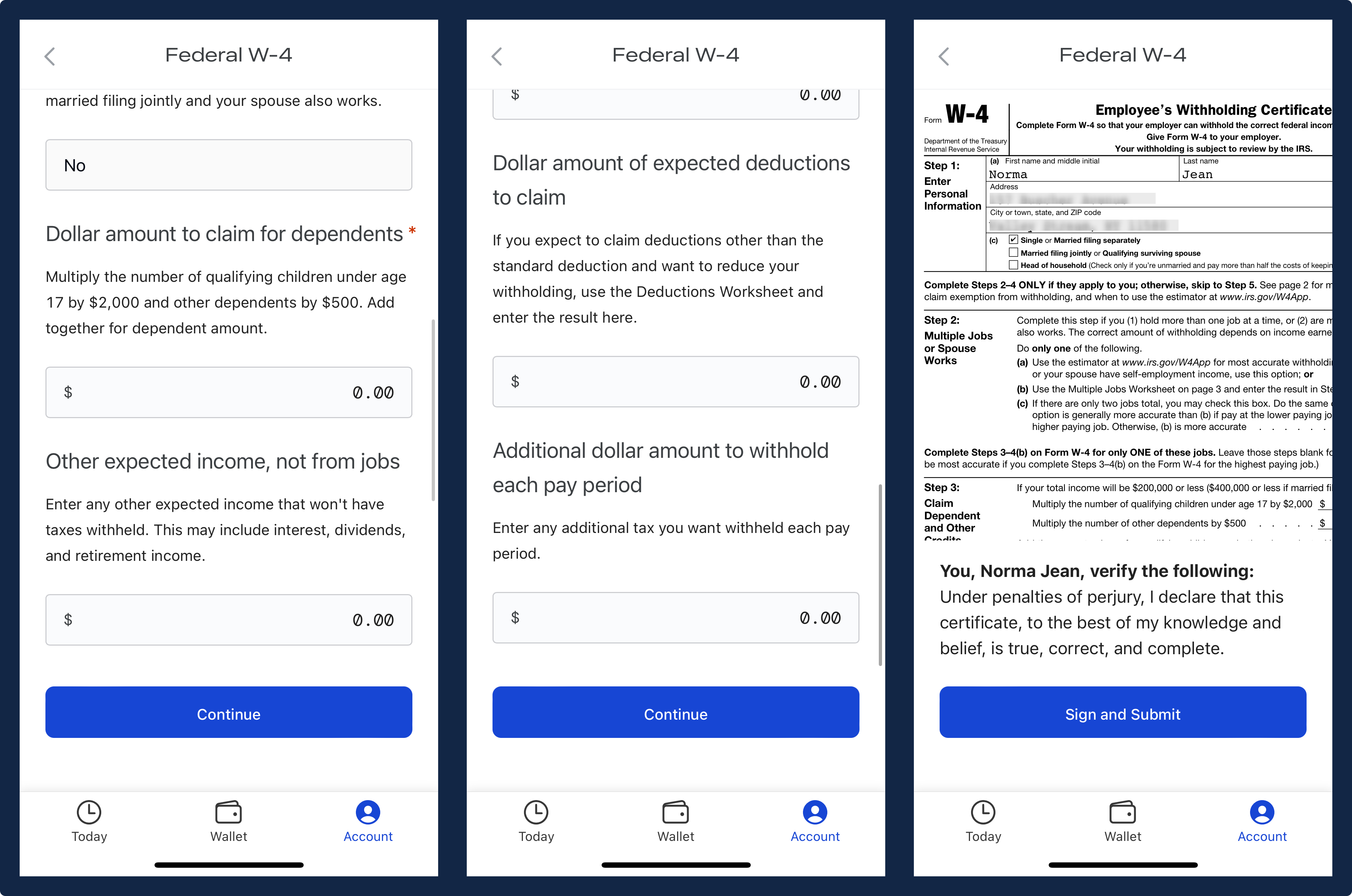

Federal W-4 tax form

- On the “Federal W-4” and “Federal 1099” screen, you will be asked to fill out all fields required to complete the form. The

Continuebutton will not be enabled until all required fields are filled out. After you have completed all fields and theContinuebutton is enabled, go ahead and click it.

- Now, you will be redirected to the final page where you can review and verify all the details in your federal tax form. When you’re ready, go ahead and select the

Sign and Submitbutton.

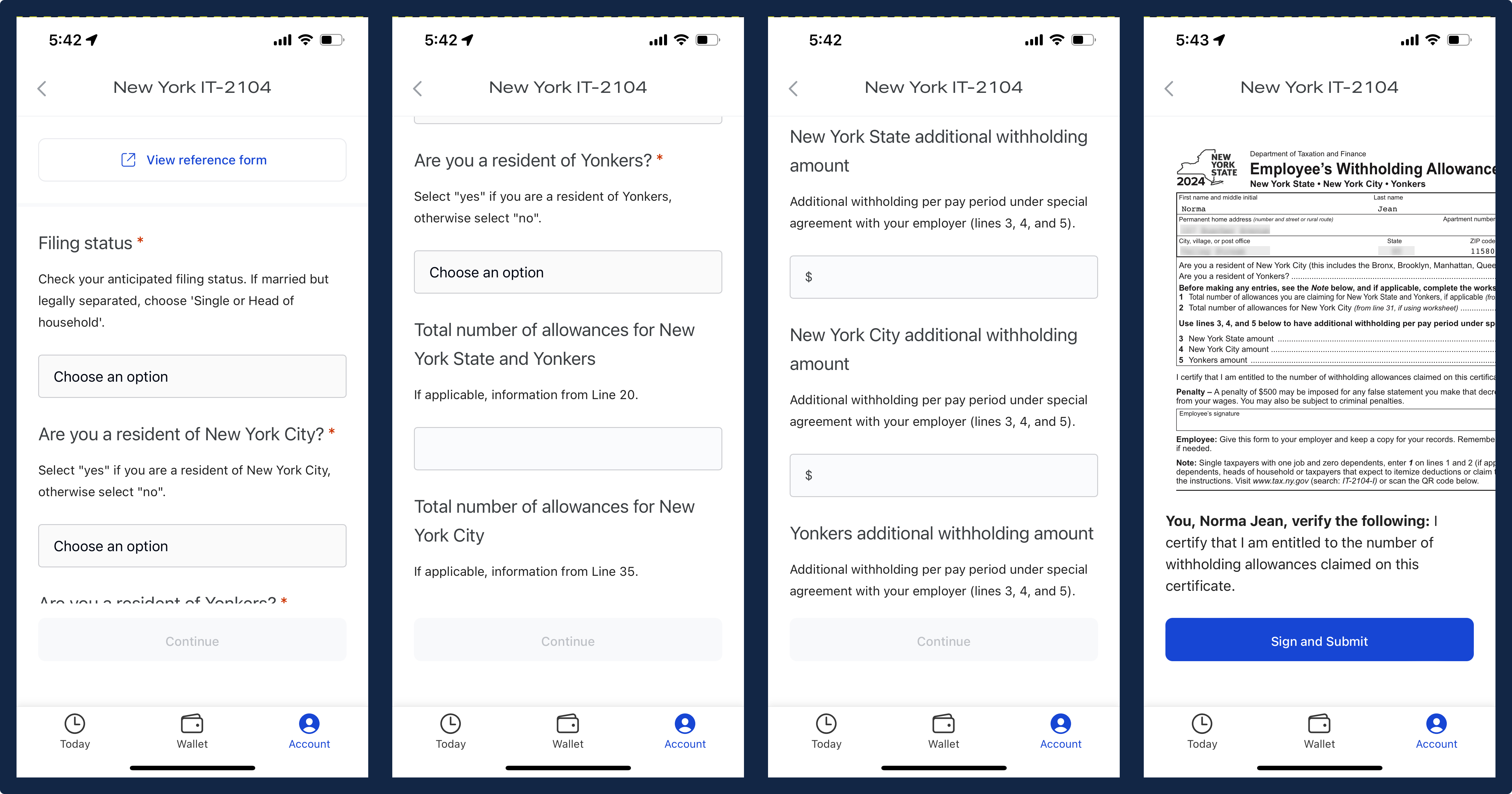

State tax form

- Similarly to the federal tax setup, you will have to fill in all required fields to enable the

Continuebutton. Once you have completed all fields, you can go ahead and clickContinue. - In the following screen, you can review and verify all the details in your state tax form. When you’re ready, go ahead and select the

Sign and Submitbutton.