Getting started: I do not have a previous provider

Tags: Onboarding, Process, Subcontractors

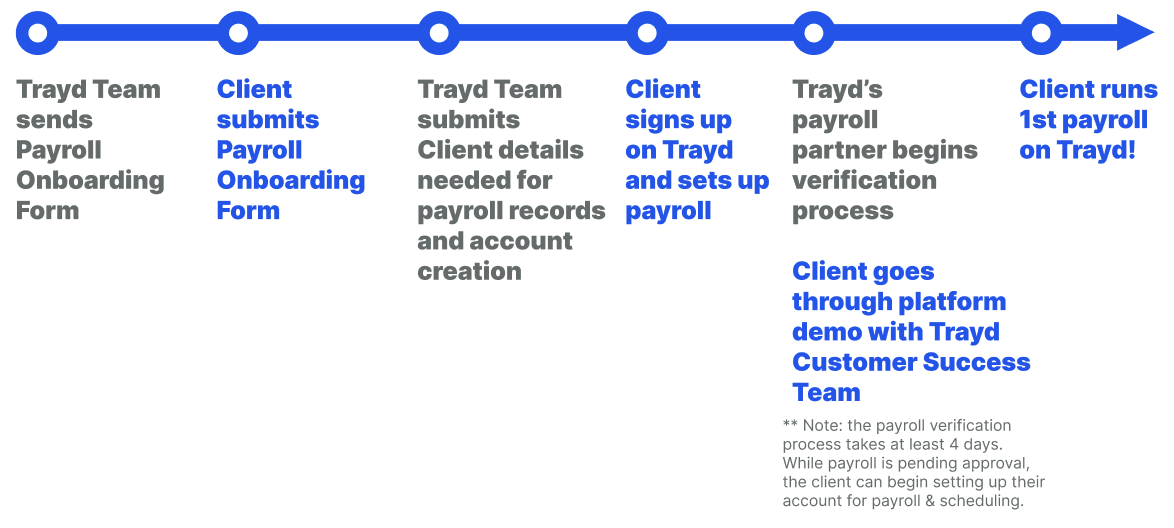

Subcontractor onboarding process

Payroll pre-onboarding: form

Before creating your account on Trayd, we’ll need a couple of details to verify your payroll information in our records. The Trayd team will send a pre-onboarding email from [email protected] with a link to a short survey that asks for the following payroll account setup information:

Company Details

- Owner’s Name

- Owner’s Email

- Owner’s Title

- Company’s Legal Name

- Company’s Legal Address

Payroll Details

- Previous Payroll Provider

- Payroll Frequency

- First Pay-date on Trayd

- Desired Pay Day

Company Bank Details

- Routing Number

- Account Number

Account setup

Login details

Once we receive your survey submission, your information will be recorded for payroll and you will receive a signup email from [email protected] with a link to create your business account on our platform.

To set up your account, we will need to share the following information to create your account login:

Account Login Information

-

Email Address

-

Phone Number

-

Name

-

Date of Birth

-

Residential Address

-

Social Security Number

Payroll details

To set up payroll, you will have to share some information on your business. Please make sure to have the following information readily available to set up payroll:

Payroll Business Information

-

Business Name

-

Taxpayer Identification Number

-

Legal Entity Type

-

Phone Number

-

Registered Business Address

-

Beneficial Owners Details

Payroll Setup

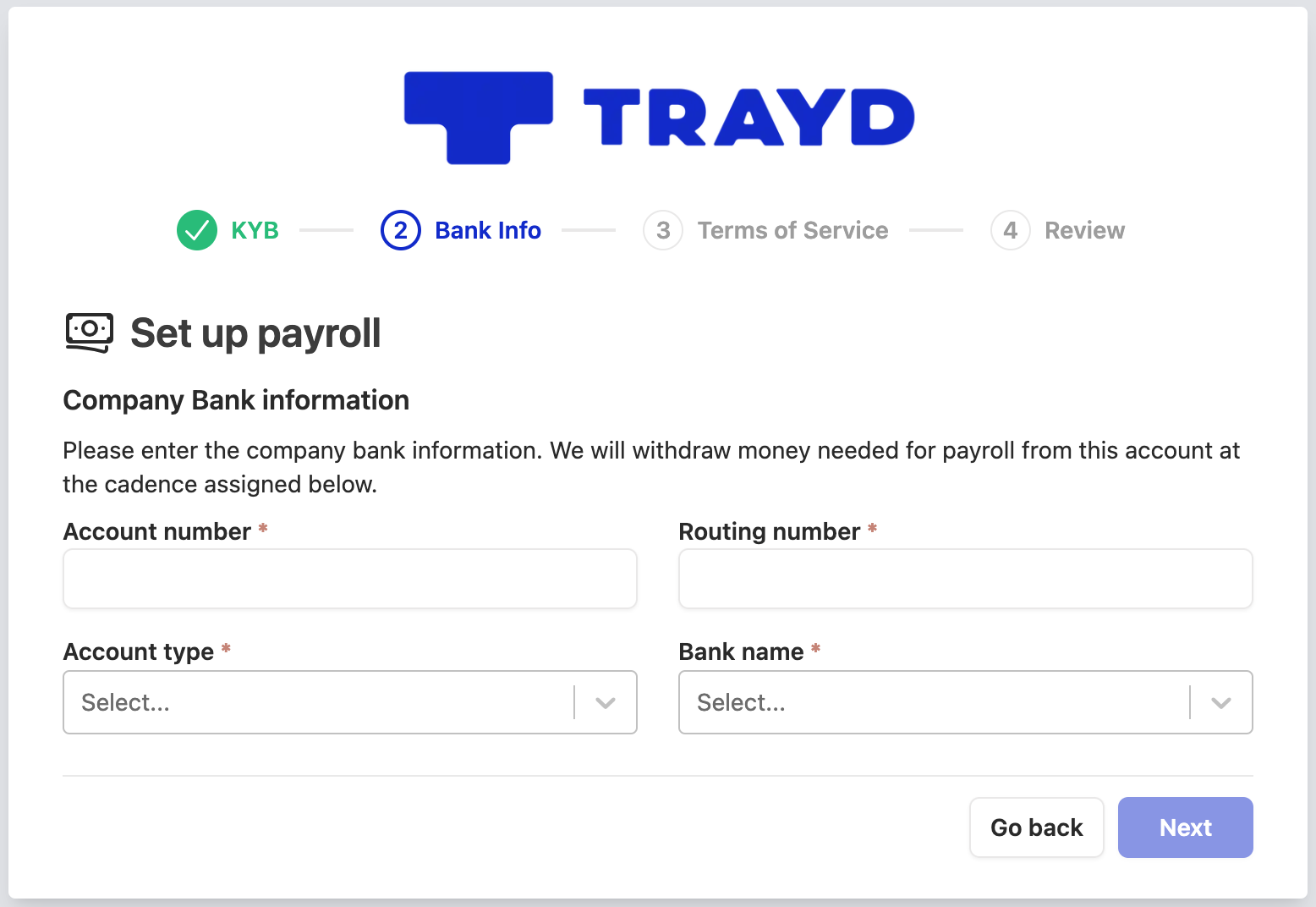

Bank Details

After adding your personal information and business information, you will be asked to authenticate your business through your phone. Once you have completed phone authentication, you will be prompted to add your business’ bank account information for payroll.

Tax details

After adding your business’ bank details for payroll, you will be prompted to complete Compliance Onboarding. It’s crucial that you complete this step to avoid being blocked from running automated payroll on Trayd. Payroll onboarding requires you to share a number of details for your tax setup.

Federal Tax Information

- Federal Employer Identification Number (FEIN)

State Tax Information

- State Unemployment Account Number

- State Withholding Identification Number

- Additional information required by your particular state

Onboarding completed

All done! Your account and payroll set up is complete.

Now that you are set up, you can get started on learning how to use the platform to improve your back office automation capabilities. Our Customer Success team will reach out to schedule your 1st platform demo. Please be on the look out from an email from [email protected] to schedule your demo.

Once your account is set up and payroll is verified by our secured payroll partner, our Customer Success team will reach out to schedule a walk-through for your 1st payroll run on Trayd.